But what about his services to Australia, a key objective in the finance minister role? That scorecard is not so impressive. The failures in the finance portfolio since September 2013 encompass several areas, including government spending and revenue, net and gross debt, and the interest bill. Few seem to interest the mainstream commentariat, which is strange because all are important.

Moreover, despite the blowout in debt and increase in government spending there has been no increase in the wellbeing of Australians, relative to the rest of the developed world, as measured by any economic indicator. This includes un/underemployment figures, wages growth, productivity and so on.

True Lies: Mathias Cormann caught by his own department for economic fairy tales

Government spending

The Abbott Government surfed into office in 2013 largely on the back of outrage against Labor’s “reckless spending” and “disastrous deficits”. In Labor’s last three years in power, federal spending averaged 24.3% of gross domestic product (GDP). That was quite low in historic terms for Australia and relative to comparable countries. In Labor’s last full year, 2012-13, spending was cut to $367 billion — 23.9% of GDP.

Abandoning all promises, the incoming Coalition with Cormann as finance minister swiftly reversed this thrift. Outlays rose to average 25.4% of GDP in the first three years, and 24.7% over the last three. In the year to May, spending was above $489 billion, against MYEFO estimates of $456 billion.

Government revenue

Spending is no problem if revenue is flowing in. But it isn’t. This is largely due to the failure to collect taxes from the top end and foreign corporations. Revenue to the end of May was just $429 billion, against the MYEFO’s target of $457 billion.

Note: Most data in this analysis is from the monthly Finance Department reports and the weekly gross debt updates from the Office of Financial Management.

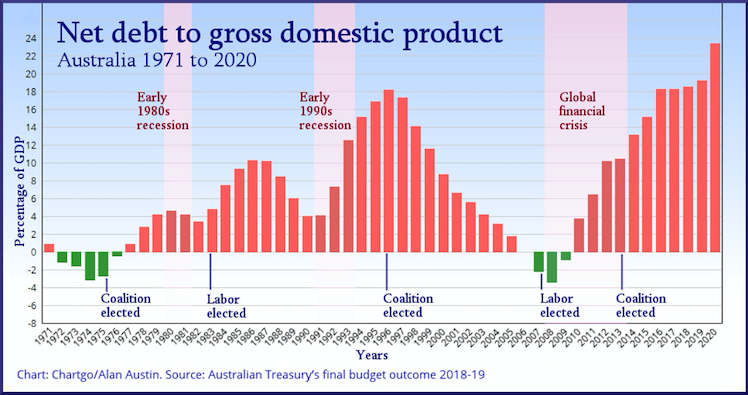

Net debt

Before the 2013 election, Tony Abbott said the Coalition would reduce net debt by $30 billion. (Net debt is gross debt minus interest-bearing loans.) Within nine months $30 billion had been added.

From $161 billion at that election, net debt continued to blow out to reach $400 billion last September. In May, this reached $464 billion, a total expansion of $303 billion.

Gross debt

From just $272 billion in September 2013, gross debt soon shot through $300 billion, to eventually reach $600 billion in May this year.

By April 2017, the Coalition doubled all Labor’s gross debt, and by March 2019 it had doubled all debt accumulated by all governments since 1854.

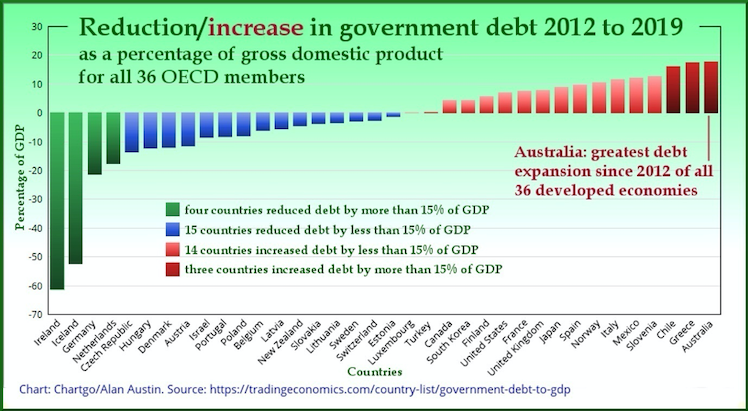

Global comparisons

Yet there has been no need for any extra debt since 2013. We know this by tracking the 36 wealthy, developed economies in the Organisation for Economic Cooperation and Development (OECD). Of these, a clear majority has taken advantage of the global boom in investment, jobs, profits and government revenue over the past six years to repay the borrowings needed during the global financial crisis.

Between 2012 and 2019, 19 countries reduced their debt, four of them by an impressive 15% or more. Fourteen increased debt over that period by less than 15%. Just three – Chile, Greece and Australia – increased borrowings by more than 15%. Of these, Australia’s was the worst, at 17.6% of GDP.

The interest bill

Interest paid on gross borrowings in the financial year just ended will be about $17 billion, which equates to about $1,180 per taxpayer per year. That is cash the Government must transfer to mostly offshore lenders.

Net worth

The mainstream media generally ignores this indicator of success in financial management, which nearly always reflects well on Labor but poorly on the Coalition.

Net worth measures all federal government assets minus liabilities. Assets include cash, investments, land, buildings, infrastructure and heritage and cultural assets. Liabilities include government borrowings, debts to suppliers, superannuation and other employee debts. [See the top table of page one of the monthly finance statements.]

Australia’s net worth has tumbled under the Coalition from negative $206 billion to negative $624 billion.

Note on MMT

Modern monetary theory (MMT) claims deficits and debt pose no problem to countries like Australia with sovereign currencies, as they can never run out of money. While this is true, budgets framed by both sides of politics are still heavily constrained by revenue. Hence, in the real world, that $17 billion paid in interest on the unnecessary debt is not available for other priorities, which reflects a lowering of the quality of Australian life.

Overall decline in outcomes

Through the past six years of the global recovery Australia has tumbled from near the top of OECD rankings to among the losers on unemployment, underemployment, wages growth, productivity, income per person, median wealth, retail sales, infrastructure development, interest rates and the value of the Aussie dollar.

———————-

https://www.michaelwest.com.au/cormann-duttons-60000-domestic-raaf-flights/

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.