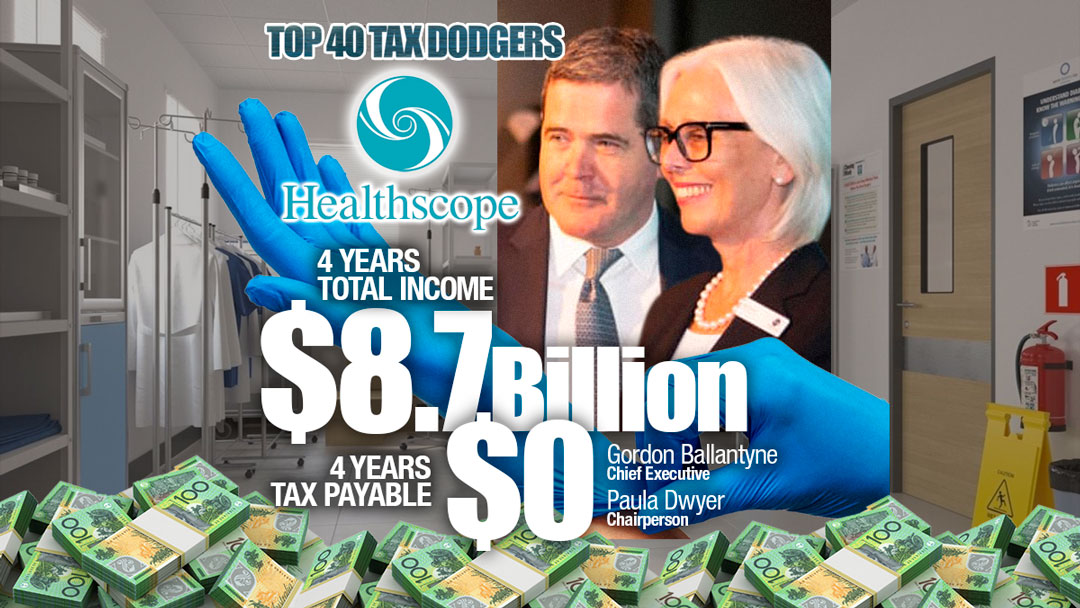

Healthscope Ltd

| 4 year total income | $8,728,041,858 |

| 4 year taxable income | $15,698,759 |

| Margin | 0.18% |

| 4 year tax payable | $0 |

| Tax Rate | 0.00% |

| Auditor | Deloitte |

| Industry | Health |

| Links |

It is no small irony that this tax dodger is subject to a takeover by another tax dodger, Brookfield, whose secretive entity BPIH romped into the Top 40 this year at #32.

Healthscope looks to have used up its ample supply of tax losses and the tax expense in its latest set of accounts indicates they may have to actually pay tax this year. If directors, as they have presaged, accept the $4.5 billion bid from Brookfield, it is likely that Healthscope won’t pay tax as Brookfield has notorious tax haven connections and sends billions of dollars in capital to Bermuda from the Australian assets which it controls.

Healthscope owns 43 private hospitals and a suite of medical centres. It was floated on the ASX in 1994, taken private by vulture funds TPG and Carlyle in 2010. They floated it again for a large profit in 2014, only it to deliver a poor performance for ASX shareholders, and lately some attention from the Tax Office. Auditor is Deloitte.

The Tax Office figures lag but Healthscope’s latest accounts record tax paid of just $15.4 million last year and $13.7 million the year before (this may be tax paid overseas). The notes also disclose that, last year, the Tax Office “completed a streamlined assurance review of Healthscope’s Australian business. The ATO has indicated that it may undertake a more detailed review in respect of various matters that relate to the pre-IPO period, and Healthscope’s utilisation in the post-IPO period of tax losses”.

In other words, the Tax Office suspects Healthscope’s former owners TPG and Carlyle have been up to no good, which is no surprise.

Public support is vital so that we can continue to investigate and publish articles that tell truth to power. Subscribe with a monthly contribution if you can, see below. Join our newsletter, share and like posts, if you can not make a financial contribute.

2019 METHODOLOGY

We are counting down the Top 40 Tax Dodgers. There are now four years of tax transparency data published by the Tax Office and we have used this data to work out which large companies operating in Australia have paid the least tax, or no tax.

Notable new economy players such as Google, eBay, Booking.com, Expedia are not near the top of the ATO list. That’s because they don’t (yet) recognise all income earned here; instead, they book Australian revenue directly to their associates offshore. They will be ranked in due course.

For other large corporations, and in particular, multinationals, the main steps in avoiding tax are made by reducing their taxable as much as they can; usually by sending it offshore in interest on loans, “service” fees or other payments to foreign associates. So, we have set a threshold. We have included only those companies which managed to wipe out 99.5 per cent or more of their taxable income over four years.

Qantas, therefore, is not on this list, although it has enormous income and has paid no income tax in Australia for many years. It misses the cut-off due to it not eliminating more than 99.5 per cent of its total income.

The airline had made large losses which were offset against profits. Many large corporations which have paid zero tax in ATO data, have legitimately made losses and have therefore built up “tax-loss shelter”.

Further explanation of methodology can be found here.

Many others however, such as ExxonMobil and EnergyAustralia, are on the list as they managed to eliminate all or most of their taxable income by “debt-loading” or other means of aggressive tax avoidance.

In this, the second iteration of michaelwest.com.au corporate tax rankings, we have ranked companies purely on the Tax Office data. We will also publish a list of Australia’s better corporate taxpayers, those companies who contribute most to the country in which they operate.

The Tax Office data is not a perfect guide. It does not record refunds, only tax payable and is often at odds with disclosures made for accounting purposes. In some cases, there are multiple entities with the same ultimate offshore parent reporting. One entity may pay zero tax, another may pay at the statutory 30 per cent rate (even if on low taxable income). We endeavour to be fair in our reporting to recognise these issues.

The data also recognises trusts as well as companies. For trusts, it is the members (investors) rather than the trusts who are ordinarily required to pay the tax. In many cases however it is fair to recognise trust structures for what they are, as tax is often the main reason these vehicles have been structured as trusts.

Companies are welcome to debate their rankings or to touch base to clarify or defend their tax practices. We will append or link these submissions.

Hydrox has been taken off the list as it never made a profit.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.