Is yet another suite of essential Australian assets headed off to a tax haven? Michael West reports on the takeover of private hospital operator Healthscope and its Caribbean-connected suitors.

Shares in Healthscope shot up on Friday as prospects for a successful takeover bid from the Brookfield group firmed.

Who is this Brookfield? The question matters because it is now odds-on to take control of 43 hospitals in Australia, key health assets which are heavily subsidised by all of us, the taxpayers that is, via the $6 billion government subsidy of private health insurance.

Here is a taste of Brookfield. We stumbled across them again last week while investigating Tax Office data for our annual Top 40 Tax Dodgers countdown.

Already, the financiers from Brookfield have control of billions of dollars of Australian infrastructure – essential assets such as ports, rail lines, gas and water licences, along with vast property holdings.

Where do the profits go? This mysterious BPIH, just one of their constellation of vehicles, has siphoned off almost a billion dollars to associates in Bermuda over the past two years alone. Meanwhile, this Brookfield subsidiary has paid zero tax in Australia over the four years of available Tax Office transparency data.

Why should we care? We should care because a lot of the things which are now controlled by Brookfield were once owned by taxpayers. Others, such as the Healthscope assets, have been subsidised by taxpayers.

For an example of how damaging the destruction of public wealth can be – in favour of foreign multinational interests, that is – look no further than EnergyAustralia. Its assets were acquired through state privatisations. As power prices soared, EnergyAustralia raked in enormous profits but it has paid no tax despite racking up an humongous $30.3 billion in revenue over the past four years.

Where do the profits go? EnergyAustralia’s parent company is in the British Virgin Islands. Ultimately, the greatest share of the profits end up with one family, the family of Hong Kong magnate Li Ka-Shing.

We attempted to contact Healthscope and asked to talk with chairman Paula Dwyer:

“Brookfield entities here are controlled by tax havens and related parties are mentioned in Paradise Papers etc. What does the chairperson have to say about hospitals potentially falling to Bermuda control?

What is the relationship between the Healthscope bidding vehicle and Brookfield’s other entities in Bermuda and other tax havens?

No response from Dwyer. A stonewalling from the Healthscope PR machine.

And Brookfield? Same deal. We asked: “This (BPIH) and related entities come up in the ICIJ (International Consortium of Investigative Journalists) offshore leaks database. What would Brookfield say to assuage public concerns that essential assets should not be controlled by tax haven entities?”

Inevitably, directors were not available for comment. No response to the questions on Bermuda. They couldn’t even say what the letters BPIH stood for.

Of course, it doesn’t matter what the letters BPIH stand for; the fact that they are an unremarkable, boring-looking bunch of letters is why they have been selected. Brookfield doesn’t want anybody looking.

Last year, the first year of the michaelwest.com.au Top 40 Tax Dodgers Chart, another obscure group of letters turned up at number nine as we counted down. BHCA Ltd.

As it turns out, this was a Brookfield Australia entity. Over three years it booked almost $10 billion in total income but managed to wipe it all out before the taxable income line.

This year, perhaps deliberately, BHCA has somehow got itself off our list, and therefore the Tax Office radar, and out of the public purview. Instead we have BPIH.

Let’s examine the connections.

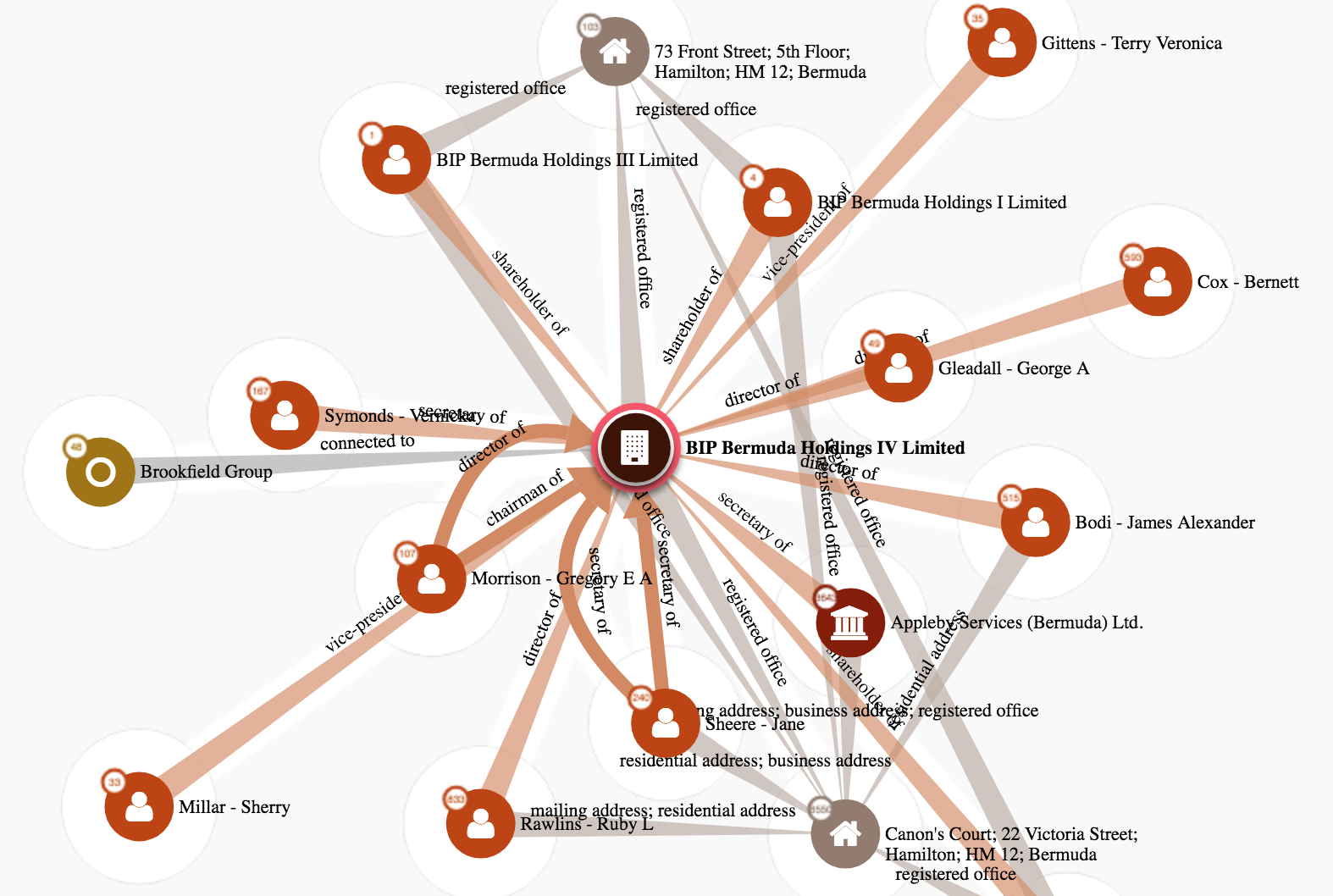

The immediate parent company of BIPH is BIP Bermuda Holdings IV Ltd which was issued another 172 million stapled securities during 2017 worth $677 million. The year before it was $184 million worth $724 million.

During last year, according to the latest BIPH accounts, the BIPH trusts made capital returns of $190.5 million. The year before it was $729 million.

Given this Brookfield entity owns vital public assets such as the terminal at Dalrymple Bay, Queensland’s premier coal loading facility, this is a lot of money to be ripped out to the Caribbean without anybody noticing.

There were also $145 million in “management services fees” paid to an associate of Brookfield Asset Management Inc whose ultimate parent is Brookfield Infrastructure Partners LP, Bermuda. This parent of BIPH, BIP Bermuda Holdings IV, features in the Paradise Papers offshore leaks database as a client of the law firm Appleby.

One of the Australian directors of BPIH, Jeff Kendrew also gets a mention in the Paradise Papers, as does its Big Four auditor Deloitte which boasts thousands of entries in the offshore leaks database.

There is no suggestion that Kendrew or his colleagues have broken any laws but the point of these kinds of structures is twofold: one, to aggressively minimise tax, and two, to hide things.

Until now, none of this has been known publicly – even though we managed to find the information publicly, it is buried and probably only known to Brookfield and its advisers.

This brings us back to the Healthscope deal. This is a $4.5 billion takeover pitch, so a lot is riding on its success: millions in fees for the teams of merchant bankers and lawyers acting for each side of the deal. UBS and Freehills are acting for Healthscope.

The central duty of chairman Paula Dwyer and her Healthscope directors is to maximise the return for shareholders. The Caribbean doesn’t really come into it, just the bid price. The higher the price, the many more millions of dollars her executives take home in bonuses, so there is a lot of impetus for this deal to happen.

Given the track record of Brookfield in Australia is to rip profits from Australian infrastructure out of the country and put it into tax havens – clearly, BPIH demonstrates this – it is now up to government to protect the interests of its taxpaying citizens.

Healthscope and Brookfield have refused to detail the tax haven connections behind the bidding entity, Brookfield Capital Partners Ltd of Canada.

Over to you Josh Frydenberg.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.