Santos Limited

Generous exploration incentives help Santos, along with its multinational gas peers, pay little or no tax. This, despite the punishing rise in gas prices for all Australian consumers.

Ironically Santos, the most troubled player in the oil and gas sector, managed to pay more tax than Chevron, BG (Shell), Puma and Victoria Power. Between them, this bevy of foreign multinationals booked $33.4 billion in revenue and paid not a cent in tax over the four years of available Tax Office transparency data.

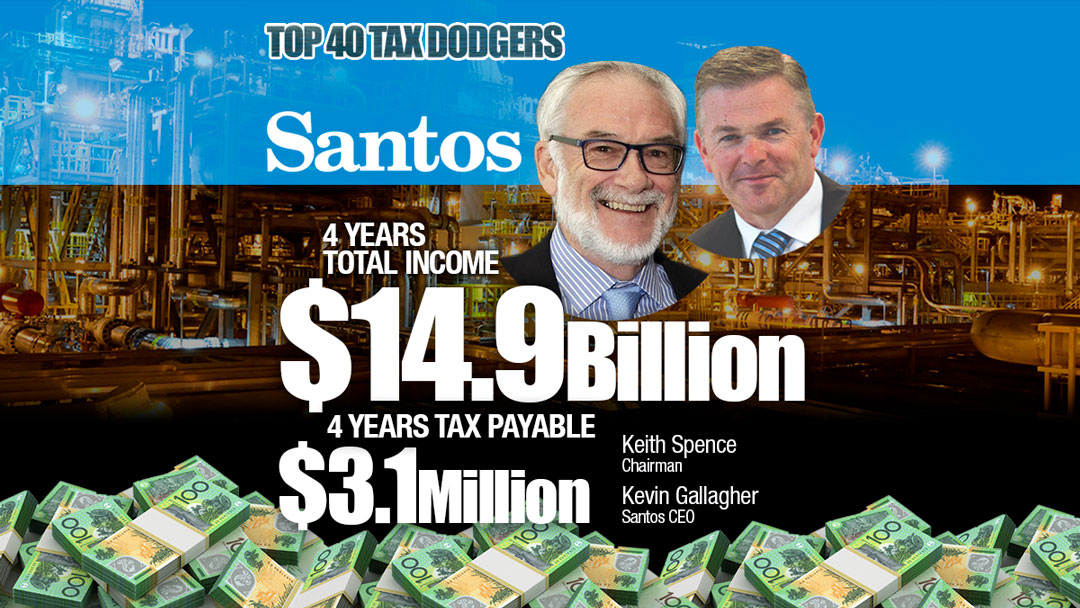

Santos racked up total income of almost $15 billion over the four years but, even on the measly $27 million which was left over in taxable income, it managed to pay income tax at a rate of just 11.5 per cent, just one third of the corporate rate. Just a touch over $3 million of its $14,938 thousand million total income.

Still, this tiny contribution of $3 million is a darned sight better than what its rival Origin Energy paid in the last year of the ATO data: zilch on $188 million in taxable income and $15 billion in total income.

And better too than EnergyAustralia, the tax-haven-controlled energy group, with its zero tax on $6.3 billion of total income, not to mention renowned tax cheat Exxon with its zero tax and $8.4 billion in total income.

Like its industry peers and their “independent experts“, Santos appears to confuse royalties and taxes. Next to the tax entry in its latest cashflow statements, Santos lists “Royalty-related taxes paid” of $US13 million in 2018 and $US15 million the year prior. It’s not much of a payment for extracting $US6 billion worth of natural resources which belongs to all Australians.

Royalties are not taxes, they are the payment to the state for the the natural resources.

In any case, there are many reasons corporations don’t pay tax and without finessing the explanations it is remarkable that these companies, as a collective, have sucked umpteen billions of dollars a year in oil and gas from Australia’s seabeds and coal seams but contribute virtually nothing in income tax to the societies in which they operate.

They’ve got all sorts of excuses, all true: heavy capital expenditure, high costs, exploration losses, royalties. Still, the numbers tell the story; that one number now published every year by the ATO, tax payable.

Santos won’t be paying much for a while either. It’s latest financial statements show $US1.75 billion in “deferred tax assets” to match off against future profits.

They also show there was tax paid in 2018, some $US69 million in 2018 and $US28 million in 2017 but it is quite likely this is tax paid in other countries such as PNG and Indonesia.

Santos has built an enormous bank of tax losses by dramatically overspending on the construction of its LNG plant at Gladstone in Queensland. Like rival gas producers, Origin and Shell, Santos overestimated global demand for gas and, as the price of gas fell globally, the company was forced to take massive write-downs to the value of its asset base.

Nonetheless, despite paying so little tax, Santos was in good enough shape last year to fork out $US1.5 billion for the acquisition of Quadrant Energy.

When a sale is not a sale – Origin Energy’s unreal unrealised gain

Public support is vital so that we can continue to investigate and publish articles that tell truth to power. Subscribe with a monthly contribution if you can, see below. Join our newsletter, share and like posts, if you can not make a financial contribute.

2019 METHODOLOGY

We are counting down the Top 40 Tax Dodgers. There are now four years of tax transparency data published by the Tax Office and we have used this data to work out which large companies operating in Australia have paid the least tax, or no tax.

Notable new economy players such as Google, eBay, Booking.com, Expedia are not near the top of the ATO list. That’s because they don’t (yet) recognise all income earned here; instead, they book Australian revenue directly to their associates offshore. They will be ranked in due course.

For other large corporations, and in particular, multinationals, the main steps in avoiding tax are made by reducing their taxable as much as they can; usually by sending it offshore in interest on loans, “service” fees or other payments to foreign associates. So, we have set a threshold. We have included only those companies which managed to wipe out 99.5 per cent or more of their taxable income over four years.

Qantas, therefore, is not on this list, although it has enormous income and has paid no income tax in Australia for many years. It misses the cut-off due to it not eliminating more than 99.5 per cent of its total income.

The airline had made large losses which were offset against profits. Many large corporations which have paid zero tax in ATO data, have legitimately made losses and have therefore built up “tax-loss shelter”.

Further explanation of methodology can be found here.

Many others however, such as ExxonMobil and EnergyAustralia, are on the list as they managed to eliminate all or most of their taxable income by “debt-loading” or other means of aggressive tax avoidance.

In this, the second iteration of michaelwest.com.au corporate tax rankings, we have ranked companies purely on the Tax Office data. We will also publish a list of Australia’s better corporate taxpayers, those companies who contribute most to the country in which they operate.

The Tax Office data is not a perfect guide. It does not record refunds, only tax payable and is often at odds with disclosures made for accounting purposes. In some cases, there are multiple entities with the same ultimate offshore parent reporting. One entity may pay zero tax, another may pay at the statutory 30 per cent rate (even if on low taxable income). We endeavour to be fair in our reporting to recognise these issues.

The data also recognises trusts as well as companies. For trusts, it is the members (investors) rather than the trusts who are ordinarily required to pay the tax. In many cases however it is fair to recognise trust structures for what they are, as tax is often the main reason these vehicles have been structured as trusts.

Companies are welcome to debate their rankings or to touch base to clarify or defend their tax practices. We will append or link these submissions.

Hydrox has been taken off the list as it never made a profit.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.