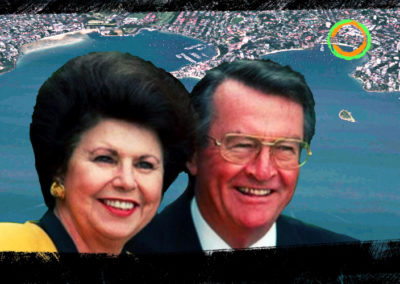

Betty Klimenko and Monica Saunders-Weinberg (right) are the daughters of Westfield co-founder, John Saunders. Their inheritance included five family-owned Dark Companies which are exempt from lodging financial accounts with ASIC and are large donors to both the Liberal and Labor parties.

| Top 200 Rich List (2020) | No. of Dark Companies: 5 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 29 | Terrace Tower Group Pty. Limited | Labor Party: $506,338 |

| Wealth: $2.73b | Terrace Tower Holdings Pty. Limited | Coalition: $730,517 |

| Wealth (2019): $2.37b | Prospect Enterprises Pty Ltd | Independent: $500 |

| YoY wealth change: 15.5% | J S Securities Pty Ltd | Total: $1,237,355 |

| Eastgardens Pty Ltd |

The billionaire pair sit on the board of all five companies on the Secret Rich List.

Monica Saunders-Weinberg is also chairwoman of the Gold Dinner fundraiser which raised $3.2 million for the Children’s Hospital Foundation in 2019. She added to her extensive property portfolio in July 2020 after purchasing an $8 million home in North Bondi.

Ms Klimenko was adopted into the family and now owns the Erebus Motorsport team based in Melbourne.

Together, the sisters established the Saunders Family Charitable Program which ranges from donations to major not-for-profit organisations and charities, to financial support for families and individuals.

Philanthropic achievements aside, the Saunders family are also well versed in the art of political donations, granting over $1.2 million to the major parties since 1998.

In 1960, their father John Saunders co-founded Westfield Development Corporation – now a global retail empire – with fellow secret rich-lister Frank Lowy. Both men immigrated to Australia in the early 1950s to escape post-war Europe.

After selling his Westfield shares to Lowy for $21 million in the mid-1980s, Saunders stood down from the company in 1987. He used the money to build his real estate and investment operation Terrace Tower Group Pty. Limited, a Dark Company and parent to his four other grandfathered entities on the Secret Rich List.

ATO tax transparency data shows Terrace Tower Group generated a total income of $1.1 billion between the financial years 2015/16 to 2017/18. In this time the Dark Company had a taxable income of $120.9 million of which they paid $36.2 million, or 30%, in tax.

Major real estate assets in Australia include Westfield Eastgardens, Supa Centre Moore Park, and head office 80 William St Woolloomooloo (pictured above). The group also runs investment operations in the US.

Like other Westfield retail centres in Australia and across the globe, the Eastgardens complex holds the Westfield name and exhibits its famed red logo. This would have shoppers believe they were purchasing their jeans, jewellery and smartphones in a shopping centre owned by the retail empire, when in fact it was property controlled solely by a Dark Company with no affiliation to Westfield or the Lowy family.

That was until 2018, when a company controlled by Terrace Tower Group sold 50% interest in Westfield Eastgardens to ASX-listed company Scentre Group for $720 million, one of the largest single-asset retail deals conducted in Australia.