A former school teacher from Copacabana Beach has just locked horns with the four most powerful private institutions on the planet. And they don’t like it. The shoddy audit standards, massive government consulting business and global tax avoidance operations of the Big Four accounting firms, EY, KPMG, Deloitte and PwC, now finally face government scrutiny. Michael West reports.

On a crisp Thursday morning early this month, Deborah O’Neill walked into the Senate with a good idea. The Senator from the Central Coast of NSW had watched events unfold in London, the retinue of scandals which had enveloped the Big Four; and their intimate connections to a raft of corporate collapses and their attendant, gargantuan, conflicts of interest.

Here, the Big Four accountancy firms – shadowy partnerships who reveal nothing of their spiralling profits – had staged another breezy escape from accountability. In the Royal Commission into the Banks, where they booked another breathtaking bevy of advisory fees, they fielded nary one question as to their own culpability in the systemic fraud perpetrated upon ordinary Australians.

Yet in the UK, the calls were rising for the oligopoly to be broken up; too big, too profitable, too failed in its self-appointed role as the Guardian of Global Commerce.

At 11.49 am, O’Neill rose in the Chamber to speak. “I move that the following matter be referred to the Parliamentary Joint Inquiry into Corporations and Financial Services …”. She went on to note the failure of audit in detecting fraud, and conflicts of interest arising from their government consulting fees. As well as booking monster fees from advising multinational corporations on how to dodge tax, it was audit and consulting which had helped the Big Four to double-digit revenue rises in recent years – yes, rises in revenue, not profits; much of this coming at the expense of taxpayers.

Hansard from August 1 records: “Question agreed to”. What Hansard did not record was the dismay at how O’Neill managed to get away with this motion, nor the surprise and high indignation of the Big Four, the bewilderment of Liberal party senators across the floor, and even the surprise among her own colleagues.

The Big Four are among the largest donors to both major parties, tipping in hundreds of thousands of dollars a year to both Liberal and Labor coffers, effectively political bribes to garner government business and to avoid precisely this kind of nosy, intrusive government activity.

This had been coming for a while, Deborah O’Neill told michaelwest.com.au last week. “They (the auditors) escaped scrutiny in the Hayne Royal Commission. ASIC has been calling on the Government to deal with the quality of auditing for the past seven years and they have done nothing. What impact does their consultancy work, which is unregulated, have over their capacity to audit independently?”

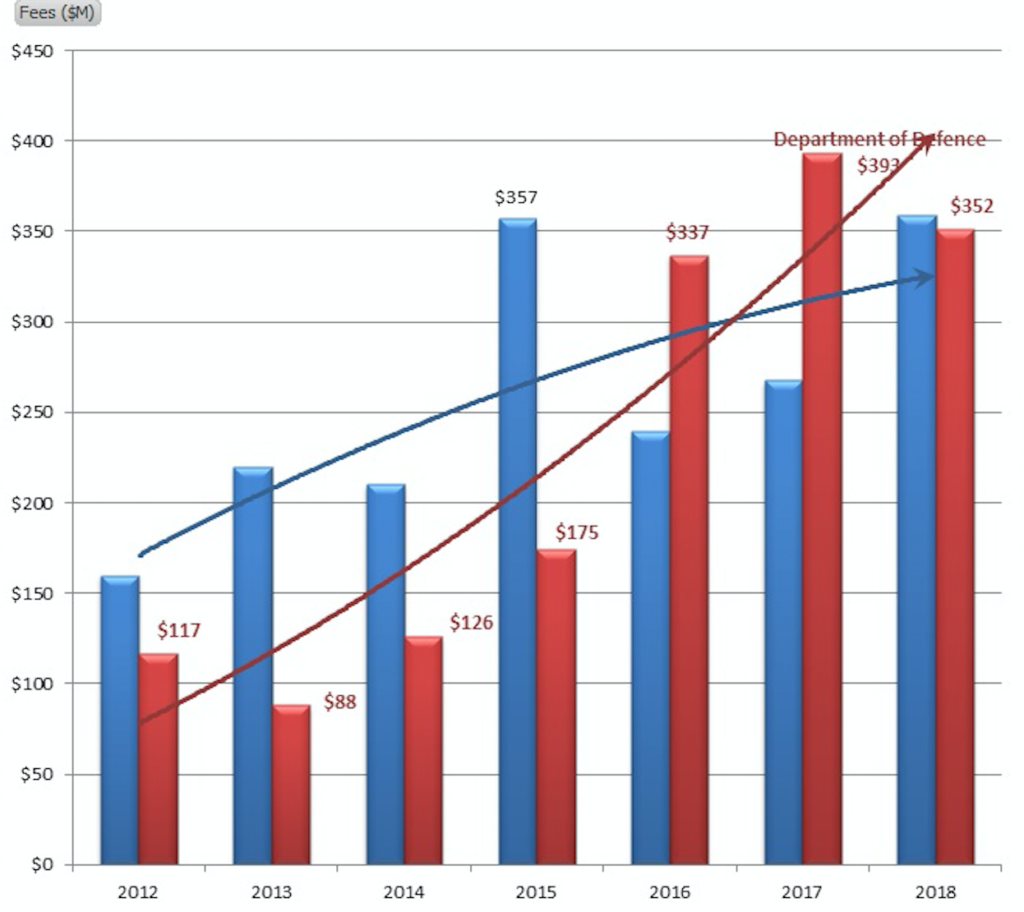

For the Big Four, the dollars at stake are mind-boggling. The following chart shows Federal Government consulting fees which have gone to these four firms alone over the past seven and a half years until this month when O’Neill called her probe. In the red is Department of Defence, in the blue, all other departments.

In the three weeks since the Inquiry was announced the phone calls from the Big Four have been flowing. “What a cheek it was to announce this inquiry without so much as consulting us” … “there is nothing to see here anyway”, sums up the mood of indignation.

“She slipped that one through,” said one long-term Labor Senate operative. Canberra insiders are variously surprised and amused that the motion was not killed from the start. Now the word is the Committee is stacked with Liberals keen to kill it and Labor senators under pressure to kill it.

One senior lawyer au fait with the practices of the firms confided the Big Four had already enlisted senior partners at the big city law firms and their Big Four colleagues in London to kill it. They will be vigorously looking at their “document retention” policies, he old this reporter, “which really means document destruction”.

“Make no mistake, they (EY, Deloitte, KPMG and PwC) will be prepared, they are preparing already. They are not, in the least, worried about this”.

Indeed, the last time they faced parliamentary scrutiny was during the 2015 Senate Inquiry into Corporate Tax Avoidance where the Big Four despatched a tight platoon of slick witnesses to bat away committee questions with casual efficiency. Their clients: Google, Uber, News Corp, Microsoft and the oil majors were suitably shown up, embarrassed for their tax chicanery. Yet, on the masterminds of global tax avoidance themselves, not a glove was laid.

As the Big Four practise their defence strategies for the audit inquiry, their lobbyists, PR people and senior partners have shifted into overdrive with phone calls to the major parties and even the press. One newspaper boss in the financial media has been summoned to the gleaming Barangaroo headquarters of one of the firms to be scolded over the “unhelpful” Big Four coverage by one of his more dutiful news reporters.

O’Neill herself is not taking anything for granted. This is not a Royal Commission and large financial institutions have “given the bird” to past inquiries, lied and refused to co-operate with documentary evidence. She expects a battle.

Five of the ten-person Committee are Liberal MPs, four are from Labor and there is one Green. The Committee chair, young Liberal Senator James Patterson, is a member of the right-wing Institute of Public Affairs and unlikely to do Deborah O’Neill any favours. Another, Andrew Bragg is ex EY, one of the Big Four. Another, Jason Falinski, has already been hosing down expectations via the Financial Review that the Inquiry will find anything of significance.

The Liberal faction, say sources, is expected to “drop ASIC in it”, that is run the line that the embattled corporate regulator the Australian Securities & Investments Commission is to blame for any deficiencies in the accounting regime. The Committee itself was reformed after the Election, newly composed with O’Neill replaced as deputy chair by South Australian MP Steve Georganas.

Greens’ senator Peter Whish-Wilson, who is big on corporate malfeasance, is likely to take the fight up to the Big Four. O’Neill herself has experience, having presided in four Corporations Committee hearings. But the power and money behind the opposing forces are formidable.

Part of the reason the Inquiry was not struck down by a vote on the floor on August 1 was that the Liberals were somewhat wedged by findings in the last Parliament that there were big problems with audit standards in Australia.

“For some time, the PJC on Corporations and Financial services has been reporting on the quality, or more accurately lack of quality of auditing in Australia,” she says. “This issue should have been dealt with in the Terms of Reference of the Banking Royal Commission.

“The Liberal-National Government failed Australians and our financial sector when they chose to exclude audit from the scrutiny of the Hayne Banking Royal Commission. I am concerned about the potential conflict of interest of these companies originally designed exclusively for audit who now offer extensive consultancy services.

“When auditors secure less than 25% of their income through auditing work, the question needs to be asked – what impact does their consultancy work, which is unregulated, have over their capacity to audit independently?”

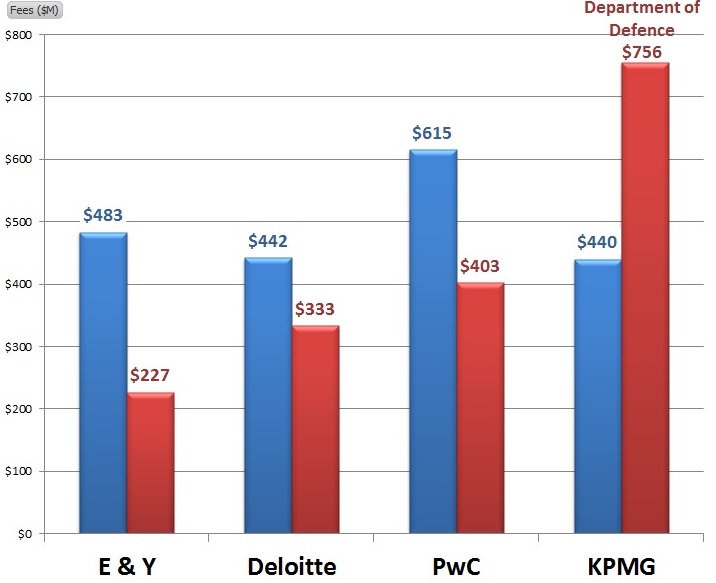

Here is another snapshot of the fee-fest. The chart below shows fees by Big Four firm from 2012 to 2018. Defence consulting is in red and all other departments blue.

Total revenue is $3.7 billion, according to analysis done for michaelwest.com.au by data expert Greg Bean. In the 313 days before Deborah O’Neill announced her inquiry Big Four revenue rose by $600 million. Collectively therefore, they make around $700 million a year for providing advice to the Federal Government alone.

Previously, the four firms had been taking 60% of their revenue out of the cash cow which is DoD. Defence spending went ballistic in the year after Tony Abbott became prime minister. Though things have tapered off slightly. In 2018, they took 50% out of DoD and so far this year have only taken 44% of total fees out of DoD.

Meanwhile, as pointed out for three years by this website, audit standards in Australia are poor, marked by persistent failures to adhere to Australian Accounting Standards (AASB) which means – as the Corporations Act requires companies to comply with AASB – that Australia’s largest companies are routinely breaking the law.

The regulatory establishment is entirely captive. There were even recent revelations that Bill Edge, the chairman of the government’s audit body, the Financial Reporting Council (FRC), was taking payments from his old firm PwC. Yet the firms have so infiltrated government that they have become “beyond regulation”.

Last week, the Committee met without representation from Labor and Treasurer Josh Frydenberg agreed to an extension of the submissions deadline from September to October 28. The Big Four are stacked with former political operatives of both major persuasions such as ex union boss Paul Howes who is now a partner of KPMG. They will not be needy of external advice on how to filibuster.

If they manage to kill the inquiry, or at least neuter it, the Big Four will buy another few years of unrestrained growth at the expense of government (which is increasingly outsourced to them), taxpayers and stakeholders in the companies which they purport to be guarding.

In the long run however it is an untenable situation to have an oligopoly of four auditors “guarding” the biggest institutions in the world, advising them how to dodge tax while advising government on tax policy and literally taking over the business of government via their consulting divisions.

A key factor in the outcome therefore will be media, which has yet almost entirely ignored these things. In its defence, the Big Four play a suave media game. Yet the spate of global document leaks such as Panama Papers, LuxLeaks and Paradise Papers, while focussing on celebrity tax avoiders, has ignored the Big Four perpetrators.

Worse, the myriad files remain locked in a document trove controlled by the International Consortium of Investigative Journalists (ICIJ) as it grows stale and beyond the access of the public. For now, the Big Four has covered all bases. The Senator from Copacabana Beach, and her colleagues, surely have their work cut out.

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.