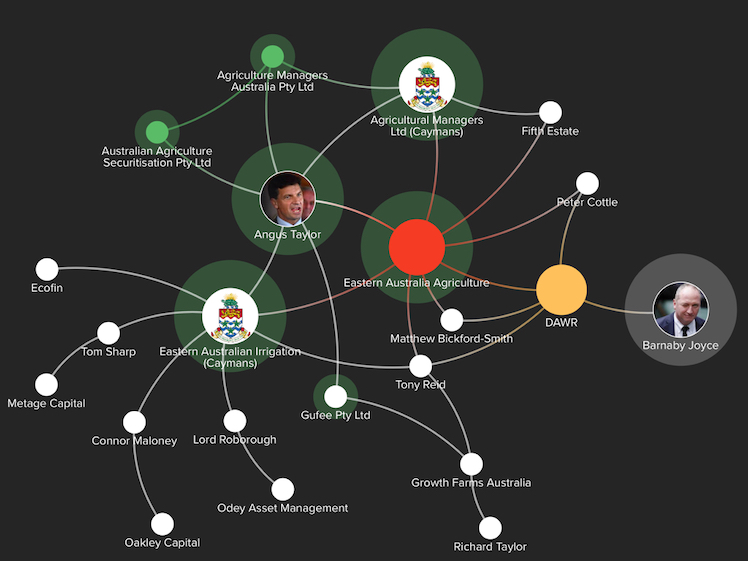

The saga of #Watergate – the $80 million water buyback fiasco – has now been widely canvassed. However, questions surrounding further mysterious parts of the issue still remain, especially concerning the long and very close relationship between two of the key figures in the story — Angus Taylor and Dr Tony Reid. Jommy Tee and Ronni Salt investigate.

CONJECTURE STILL surrounds who in the government dealt with Eastern Australian Irrigation (EAI), the Caymans-based parent company of Eastern Australia Agriculture (EAA) that held the water rights bought by the Federal Government.

One of the investors in EAI, Ecofin, made it very clear in their filing with the London Stock Exchange (LSE) that they had dealt directly with the Australian Government.

As Michael West previously reported, Ecofin made the following statement to the London Stock Exchange:

“During the summer of 2017, Australian Government authorities approached EAI with an offer to acquire some of its water entitlements. EAI was able to negotiate the price for the water entitlements to the highest level ever paid and in August 2017 it completed the largest ever sale of water entitlements in the Murray Darling River Basin.”

However, for reasons best known to themselves, the Department of Agriculture and Water Resources (DAWR), who were handling and negotiating the purchase on behalf of the Australian Government with the approval of the then minister, Barnaby Joyce, have denied dealing with EAI.

DAWR remains adamant that they only dealt with EAA itself and in an unusual move issued a denial during the caretaker period on 19 April.

“Negotiations on the purchase were conducted directly with Eastern Australian Agriculture.”

Dr Tony Reid

What is clear from the paper trail issued by the Senate is that one Dr Tony Reid wore two hats during the process, being copied into correspondence at various times during the negotiation process as either an adviser to EAA or EAI — take your pick. According to correspondence from 9 February 2016, Reid was listed as an adviser for EAA but come 7 April 2017, he was listed as an adviser to EAI. Movin’ on up.

Additionally, as Anne Davies from The Guardian has revealed, Tony Reid played a detailed role in directly dealing with the department on technical water aspects. The Australia Institute in its ‘#WaterMates‘ report provides a blow-by-blow account of Tony Reid’s involvement in guiding the DAWR and helping them measure the volume of notional “water” that would form part of the deal.

Given that Tony Reid was listed in correspondence to DAWR as being an adviser to EAI (and EAA), there can be little doubt that DAWR did, in fact, deal with someone representing EAI.

Tony Reid has admitted working as a consultant in a private capacity, accepting a fee for service for his work during the sale process but the amount that Reid received and who paid him has not been disclosed.

Interestingly, Tony Reid is a long-time business colleague and business partner of both Angus Taylor (and his brother, Richard Taylor) through a large number of company structures.

And it’s not just a “ships passing each other in the middle of the night” relationship either, but a 20-plus year armada of business engagement.

The parallel working career paths of Angus Taylor and Tony Reid include a long line of connections that continue through to this day.

Mud map graphic courtesy of @jommy_tee

The beginning of the relationship can be traced back to their respective careers at McKinsey and Co. Reid was employed at McKinsey at the same time as Taylor was a partner there, namely the period 1994 to 1997. According to Tony Reid’s LinkedIn profile, he left McKinsey in 1997.

Tony Reid’s working history from that point cannot be fully ascertained from his LinkedIn profile or other profiles, but it can be revealed that in a remarkable coincidence Tony Reid was the Chief Operating Officer of EAA from at least 2010 to 2011.

This is backed up by the fact that Tony Reid, in his capacity as Chief Operating Officer of EAA, provided evidence at a public hearing on 15 March 2011 of the House of Representatives Standing Committee on Regional Australia inquiry looking into the Murray-Darling Basin Plan.

ASIC records reveal that Reid was also a director of EAA during 2011 and 2012.

Angus Taylor himself was at EAA, EAI and other connected entities such as the Caymans-based Agricultural Managers Limited (AML) over the same period. The media at the time referred to Taylor being director of AML and that they were managing the EAA properties while Reid was EAA’s chief operating officer.

It is, however, clear that Reid’s reign as EAA’s chief operating officer finished in August 2011 and his directorship ceased in August 2012.

The little that is on the public record about Tony Reid’s employment at EAA mirrors that of Angus Taylor, with both their respective biographies being virtually silent about their EAA working stints during their careers. In fact, during the confidential $80 million contract negotiations in May 2017 that Tony Reid was a party to, the connection was enough for a person unknown to remove all references to Eastern Australia Agriculture from Angus Taylor’s Wikipedia page.

We must, of course, remember that Angus Taylor, in his limited comments on this issue, has claimed he had no knowledge of the infamous buybacks either before, during or after they happened.

Angus Taylor’s public comments have referenced the fact that once he left the companies, he had nothing further to do with them. In July of 2014, almost one year after he entered Parliament, he did, however, tell Kylie Kilroy of St George that he was in fact still in contact with EAA and offered to organise a contact for her with the company.

What is also surprising is that EAA is a company with one of the largest private water holdings in Australia as well as being one of the largest cotton growers in the country. Ordinarily having worked in management for such a leading company would be deemed a noteworthy inclusion on a person’s employment resumé and not a papered-over omission.

A search of ASIC records does, however, provide additional clues as to the intersecting business relationships between Taylor and Reid.

Both Taylor and Reid have since 1998 been – and still are to this day – involved with Growth Farms Australia, a company which controls $400 million of assets. Tony Reid’s Growth Farms Australia profile lists him as being a non-Executive Director.

Profiles of the board members are available on the website and Tony Reid’s makes no mention of his stint at EAA. The company profiles also highlight that Richard Taylor, Angus Taylor’s brother, is also a non-Executive Board Director of the company. The Taylor brothers, who founded Growth Farms Australia, gave an interview in 2015 where Angus Taylor was described as being a silent shareholder in the company. ASIC records confirm that Taylor and his wife, Louise Clegg, through their private company Gufee Pty Ltd, are shareholders in Growth Farms Australia to this day.

To underpin that Taylor and Reid are extremely close in a commercial sense and have been business confidantes for decades is also revealed by the fact that they both held directorships, at the same time, in Farmsmart Pty Ltd during the life of that company (2003 to 2009).

Additionally, through their respective family trusts – AJ & L Taylor Family Trust and AM Reid Family Trust – they were co-founders of and remain shareholders in Farm Partnerships Australia from its establishment in 2003 through to today.

There is nothing wrong with people being linked in business arrangements for decades. There is also nothing untoward about individuals being either advisers to or being directors of companies that are based in the Cayman Islands. Likewise, there is nothing wrong with an individual (Tony Reid) getting paid a fee for doing consultancy work to help seal an $80 million deal.

What may be wrong, however, is a department categorically denying that they dealt with anyone from EAI, when they did indeed engage with Tony Reid during the buyback process and were fully aware that he was an adviser to both EAI and EAA.

It is also not a good look for an elected representative to be evasive when it comes to questions about their involvement in these companies.

At this point in the scandal, it appears that none of the key actors has fully revealed their roles and certainly no one is prepared to say who in the Caymans ended up with all that money.

The above article was first published in Independent Australia.

Here you go folks…plenty to see here, despite what Angus Taylor, Barnaby Joyce might have you believe #watergate Watergate: An ecosystem cultivated for sharks won’t support goldfish https://t.co/GnWXZznRRA via @MichaelWestBiz

— ?Jommy Tee – electric HiLux owner ? (@jommy_tee) May 9, 2019

Thread:

Dirty Water – The Price We Paid

(trigger warning – dynamite, dead animals, ruined lives, off shore millionaires)

#Watergate #theprojecttv #auspol @jommy_tee pic.twitter.com/uwS3Dwwwwa— ????? ???? ? (@MsVeruca) May 5, 2019

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.