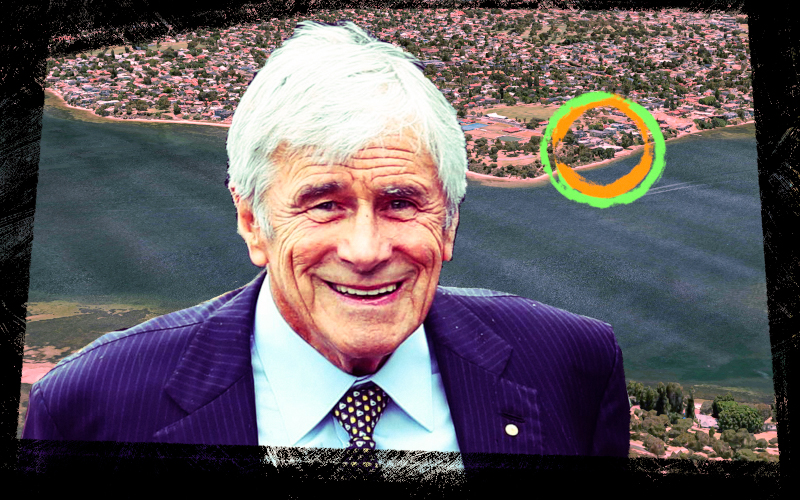

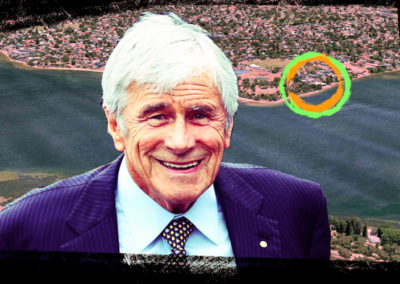

Billionaire Kerry Stokes controls most of his vast media and mining empire through Dark Companies which are exempt from normal reporting requirements. His ASX-listed investment vehicle Seven Group Holdings – controlled by an exempt company on the Secret Rich List – holds a controlling stake in Seven West Media, home of Channel Seven and the West Australian print media.

| Top 200 Rich List (2020) | No. of Dark Companies: 3 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 10 | North Aston Pty Ltd | Labor Party: $297,583 |

| Wealth: $6.26b | Australian Capital Equity Pty Ltd | Coalition: $444,696 |

| Wealth (2019): $5.69b | Westrac Holdings Pty Ltd | Independent: $174,460 |

| YoY wealth change: 10.2% | Total: $916,739 |

The 1995 grandfathering provision is not the only exemption Mr Stokes has enjoyed in recent history. During the coronavirus outbreak in April last year, he and his wife were exempted on medical grounds from mandatory 14-day hotel quarantine, returning from a US ski trip in their private jet.

Stokes began his career in property development during the 1960s and 1970s. However, it was through diverse investments and acquisitions in media, mining and construction equipment where he was to achieve billionaire status. He received an Order of Australia in 1995.

Outside his investment operations, Stokes is most notably chairman of the Australian War Memorial. He was subject to a backlash in November last year for promising to financially support Australian SAS soldiers accused of war crimes in Afghanistan. The money would be sourced from the SAS resources fund which “among other things, could cover legal costs.” An action which is deemed a misappropriation of the funds.

Stokes’ business operations are primarily conducted through his majority-owned investment vehicle Seven Group Holdings (SGH).

Significant assets of the listed company include Australia’s largest equipment hire organisation, Coates Hire, operations in the energy sector through SGH Energy and a 28.5% stake in ASX-listed company Beach Energy, large-scale equipment dealer WesTrac and a 40.2% stake in Seven West Media (ASX-listed). SGH also bought a 20% stake in building materials giant Boral (ASX-listed) in 2020.

WesTrac is one of the largest Cat Equipment dealers in the world with more than 3,000 employees. Its immediate parent is WesTrac Holdings Pty Ltd, a Dark Company owned by Stokes.

What’s more, Stokes holds a majority stake (61.1%) in SGH through his various related entities. One of which is his Dark Company North Aston Pty Ltd with two separate stakes in the listed company at 17.84% and 15.79% respectively. These are the two highest stakes held by any company in SGH.

His other Dark Company Australian Capital Equity Pty Ltd (ACE) is also part of the related entities which make up for the 61.1% stake. ACE owns the Napier Downs cattle station in Western Australia and is the parent of Wroxby Pty Ltd which holds a controlling stake in Capilano Honey and BCI Minerals (ASX-listed), as well as significant shares in Saracen Minerals (ASX-listed).

ACE’s parent company is Clabon Pty Ltd which sees famous businessman David Gonski and former West Australian Premier Richard Court sitting on the board of directors.

ATO tax transparency data from financial years 2013/14 to 2018/19 shows SGH earned a total income of $22.2 billion yet only paid $120.8 million in tax. For three of these six years, SGH paid $0 in tax.

Stokes’ majority stake in SGH means that all of its investments and acquisitions listed above are primarily controlled by a Dark Company.