The new “Your Future, Your Super” legislation avoided the most egregious of changes proposed by the LNP Government. YFYS will simplify and streamline the $3 trillion super system, fix “zombie accounts” and spark fund takeovers, writes Harry Chemay. The changes go some way to addressing a key question posed during the Hayne Royal Commission: “what do trustees do in the dark with our super?”

The recently passed Treasury Laws Amendment (Your Future, Your Super) Bill 2021 (YFYS) is set to shake up the superannuation sector the way few preceding reforms have in the near 30 years since its inception.

These YFYS changes are, by some margin, the most significant reforms since the Cooper Review of 2009-10, which led to simplified ‘MySuper’ products being introduced in 2014 for disengaged members and new employees via enterprise bargaining arrangements.

The changes are directed primarily at the 70% of the super system regulated by the Australian Prudential Regulation Authority (APRA). That’s basically the 160-odd funds dominated by retail and industry super, managed by superannuation trustees who are legally responsible for their conduct. The nation’s 597,000 SMSFs have, for the most part, escaped YFYS relatively unscathed.

For the so-called ‘APRA-regulated’ sector however, YFYS will be a game changer. It will almost certainly result in fewer funds over time, but higher retirement balances for most of Australia’s 16 million superannuation members.

Reducing Duplicate Accounts

In its landmark 2019 report into superannuation efficiency, the Productivity Commission found a system awash with some 10 million “zombie” accounts, collectively costing Australians $2.6 billion per year in excess fees and insurance premiums.

These ‘unintended multiples’ are a consequence of the way in which super accounts can be created for new employees, some who have no choice in the matter, as people change jobs. They’ve been a boon for the few funds that dominate the EBA system, with administration fees and insurance premium revenue based more on numbers of accounts than account size.

Under YFYS, employees will be “stapled” to one default (MySuper) fund when they first start working, with that fund thereafter portable, moving with changing employment (unless an alternative fund is chosen by the member).

From a peak of over 30 million accounts a decade ago to some 23 million presently, stapling will drive a further shrinking of unnecessary accounts. That is a big win for consumers, estimated to add some $50,000 to average retirement balances from fewer duplicated fees and charges.

Trustees Under the Pump

Super trustees have long had a fiduciary duty to act in the best interests of members, since it was codified in the Superannuation Industry (Supervision) Act of 1993.

YFYS ups the ante significantly, with trustees now under a best financial interests duty (BFID) to not engage in any profligate spending that might harm member retirement benefits unduly.

Somewhat unusually, BFID as drafted inverts the evidentiary burden of proof from the regulator, APRA, to trustees, in a bid to make it easier to both investigate and prosecute wrong-doing.

While BFID applies to both industry and retail funds, it is very likely to be felt more acutely by the former, as member funds are commonly used for activities aimed at retaining existing industry fund members and attracting new ones.

Retail funds, by contrast, may have corporate structures that allow for such expenditures to be borne by other entities, and not directly by members (although member net returns may in turn be impacted by payments to these entities).

Underperforming Funds Named and Shamed

A new annual performance test will compare the rolling 8 year net returns of each MySuper product with what it should have attained based on its stated investment strategy.

Critically, and for the first time, the benchmark used to calculate net returns is codified in the YFYS regulations, so all funds must adhere to the same calculation methodology. This both eliminates the ability for funds to ‘game the numbers’, and allows for an apples-to-apples comparison across different funds.

Funds that underperform their designated benchmark by 0.5% per year or more in two consecutive years will have to inform all members in writing, and will be barred from accepting new members while their performance remains sub-standard. The tests will, in effect, be Key Performance Indicators (KPIs) for super funds.

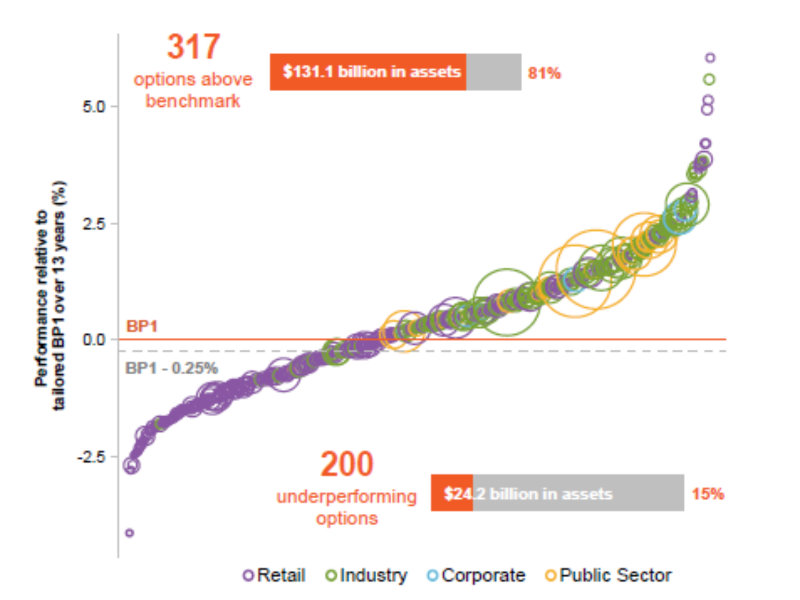

Based on the following chart from the Productivity Commission final report, there will be many APRA-regulated funds that find themselves falling short of the mark.

- Source: Productivity Commission (Superannuation: Assessing Efficiency and Competitiveness), Inquiry Report No.91, 21 December 2018

A more recent APRA MySuper study found nearly half of all MySuper products had either ‘Significantly Underperformed’ or exhibited ‘Some Investment Concerns’.

It is thus unsurprising that super trustees are dreading the annual performance test, many privately acknowledging two strikes akin to a ‘kiss of death’, starving funds of new members and scaring away existing ones.

As part of YFYS a new consumer initiative was launched on 1 July, with a YourSuper portal added to the ATO website allowing members to review the performance and cost of different MySuper products, and to view the annual performance test outcomes (due to commence shortly).

A version available via the myGOV login will allow users to compare all MySuper products they currently hold. This heightened transparency will empower consumers to make better decisions, which in turn should spur competition amongst funds to deliver better member outcomes.

YFYS Bill a Battleground

That the YFYS Bill was so heavily contested during its journey from initial draft to final passage in the Senate speaks volumes about how high the stakes are for the respective players.

YFYS applies primarily to MySuper products at this stage. These 84-odd products only account for some $850 billion, or 40%, of the $2.1 trillion currently in APRA-regulated funds.

This disproportionately impacts industry funds, with retail super more likely to be invested in non-MySuper (choice) products, often as part of advice received from a Financial Adviser. There is, however, provision for YFYS to be expanded to these choice products from 1 July 2022.

The Bill as initially proposed sought to exclude administration fees from benchmarks to be used in the annual performance test. This could have heavily advantaged retail funds and was vociferously, and successfully, opposed by the industry fund camp.

Then there was an initial clause that would have given the Treasurer powers to deny or overturn any expenditure that he or she believed contravened BFID. That provision was scrapped in last minute horse-trading with cross-bench Senators.

Winners and Losers

The passage of the YFYS Bill is a small but significant step toward ridding Australia of what the Productivity Commission coined the “unlucky lottery” of superannuation.

For too long everyday Australians have been denied, through a combination of engineered complexity and opacity, the ability to easily connect with well governed, low-cost, high performing super funds.

YFYS goes some way toward redressing this power imbalance.

It will almost invariably result in the consolidation of the super sector. Banks, badly scalded by the findings of the Hayne Royal Commission, are in mass retreat, either selling out or selling down their super interests. The retail sector looks to be consolidating around the two biggest institutions still committed to super, IOOF and AMP.

The industry fund sector will see a lift in merger activity, as trustees of sub-scale funds assess their chances of successfully negotiating the annual performance test and improving member outcomes. Evidence of this is already apparent, as the rush to get big or get out intensifies.

This need not be a cause for concern. To the contrary, Australia has been an outlier in the global pension world until now. Almost no other first-world retirement system has such a fractured pension industry.

While $3.1 trillion in super is substantial in aggregate, individual Australian funds are relatively small by world standards. At around $200 billion+, Australia’s largest fund, AustralianSuper, does not even make the current list of the 20 largest pension funds globally.

Pension funds are a scale business, and to date most Australian funds have simply not been large enough to drive costs materially lower, and thus net returns higher, to the benefit of their members.

It will take time, but the YFYS changes will lead to a much-overdue consolidation of Australia’s super industry. And with it, households will no longer pay, on average, more than twice in superannuation fees and charges what they spend on electricity. Now that would be an efficiency dividend to benefit everyday Australians.

Harry Chemay has more than two decades of experience across both wealth management and institutional asset consulting. An active participant within the wealth and superannuation space, Harry is a regular contributor to investment websites in Australia and overseas, writing on investing and financial planning.