It appears John Barilaro, and his wife Diane have avoided paying over a hundred thousand dollars in GST from renting out their luxury getaway ‘Dungowan Estate’ despite it potentially qualifying as a commercial residential premises. What’s the scam?

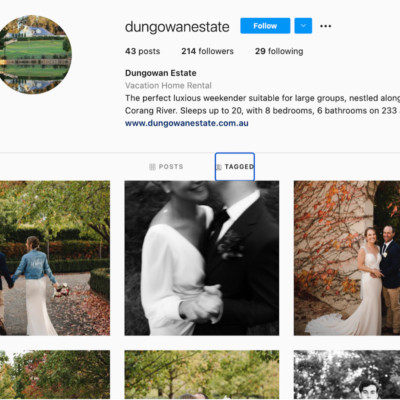

John Barilaro and his wife Dianne Barilaro have been renting out their luxury, 233-acre Dungowan Estate for functions and getaways, privately and through hosting apps such as Airbnb and Stayz.

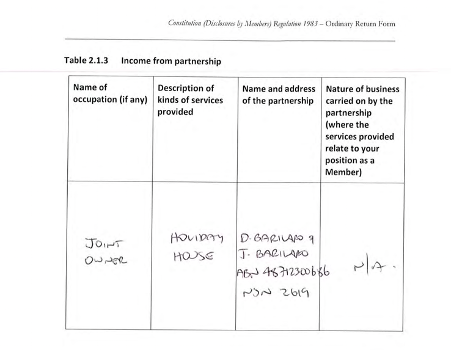

According to John Barilaro’s pecuniary interest documents lodged with NSW Parliament, the Deputy Premier and his wife formed a family partnership by the name of ‘D BARILARO & J BARILARO’ in 2014 to handle the proceeds of their “holiday house”, being joint owners.

John Barilaro pecuniary interest declaration.

According to the Australian Business Register, the partnership is not currently, nor ever has been, registered for GST.

According to the Australian Tax Office, those who let properties, only need to pay GST if they provide accommodation in a commercial residential premise. A commercial residential premise is defined by the ATO as providing “accommodation to multiple, unrelated guests or residents at once”.

Once the turnover from renting out a commercial residential premise exceeds $75,000, its owners need to register for GST.

According to its own website, www.dungowanestate.com.au, the “luxury escape” can house separate parties, with guests being invited to rent either separate wings of the main house, the Guest House, or the Boathouse.

This would clarify the residence as a “commercial residential premise” according to the definition above.

Sources who have stayed there confirm that the guest house is self-contained and separate from the main house.

According to the SMH, a listing description by Ray White real estate agents at Braidwood from 2014 states: “Currently partially leased for executive holiday stays, the property generates an income of over $160,000 pa”.

If the estate has made the same annual turnover as it did in 2014, then the total GST payable may be upwards of $112,000 on $1.12m in total turnover from the past 7 years. It should be emphasised that these are our calculations. Although they have not been refuted by the office of the Deputy Premier.

Records show the Barilaros purchased the property, “Dungowan Estate”, at Oallen near Braidwood, for $2.015 million on June 13, 2014.

The property also generates income as a wedding venue.

John Barilaro has declined to respond to questions for this story.

Callum Foote was a reporter for Michael West Media for four years.