Prolific property developer and political donor Harry Triguboff owns the Meriton Group which contains one Dark Company exempt from lodging financial accounts with ASIC.

| Top 200 Rich List (2020) | No. of Dark Companies: 1 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 7 | Meriton Apartments Pty Ltd | Labor Party: $1,177,019 |

| Wealth: $14.42b | Coalition: $2,191,934 | |

| Wealth (2019): $13.54b | Independent: $5,000 | |

| YoY wealth change: 6.5% | Total: $3,373,953 |

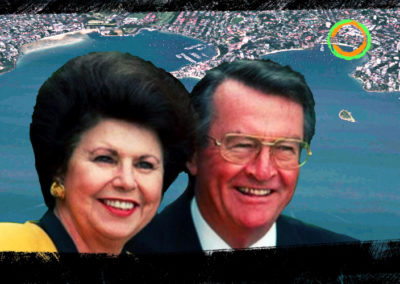

The son of Russian Jewish parents, Harry Triguboff was born in Liaoning, the Republic of China in 1933. He spent his childhood in a Jewish community in Tianjin before moving to Australia in 1947. Here he attended the Scots College, an affluent private school in Sydney’s Eastern Suburbs.

After studying textiles at the University of Leeds in England, Triguboff returned to Australia in 1950, gaining citizenship in 1961. He founded Meriton in 1963.

His business has grown to become the largest apartment developer and residential builder in Australia. It also operates the Meriton Suites brand in Sydney, Brisbane and the Gold Coast for serviced apartment accommodation. The organisation reportedly made 30 sales in the first week of 2021.

The Meriton empire is named after Triguboff’s second development of a block of 18 units on Meriton Street in Gladesville, Sydney which was completed in 1968.

Triguboff is no slouch when it comes to political donations, gifting over $3 million to the major parties since 1998. Some states and territories have banned political donations from property developers. The NSW government introduced legislation in December 2009, Queensland in 2018 and the ACT which comes into effect on 1 July, 2021.

Yet this has not deterred arguably the largest property developer in Australia. Despite the 2009 laws in NSW, AEC data shows Triguboff donated $180,000 to the NSW Liberal Party and $30,000 to the NSW Labor Party between financial years 2013/14 to 2018/19. This despite Labor’s condemnation of the NSW Nationals allegedly accepting donations from fellow property developers the Stack family.

The Group also made significant donations during the 2019 federal election issuing $60,000 to Labor and $380,000 to the Liberals.

What’s more, federal parliament reached a bipartisan agreement on legislation introduced in October last year to weaken these political donations laws. The new federal law “allows property developers to ignore state laws banning them from making political donations where the donation is for ‘federal purposes’”. It also raises the donations disclosure threshold in NSW and QLD from $1,000 to $14,300.

The Coalition has previously attempted to override these state anti-corruption laws in 2018, although was opposed by Labor and the Greens and struck down by the High Court the following year.

In recognition of his service to the construction industry and work as a philanthropist, Triguboff was given an Order of Australia on 26 January 1990.

His philanthropic achievements have been conducted through the Harry Triguboff Foundation. According to the Australian Charities and No-for-profits Commission (ACNC), the foundation “invests in financial assets to generate income to support philanthropic activities. It also holds real property assets to support these organisations.” It has funded projects for organisations such as the Shorashim Centre to assist immigrants applying for admission into Israel.

According to Meriton, the Group “has made a significant impact on the Australian landscape. The private company has designed, developed and built more than 75,000 apartments and some of the tallest residential towers across the east coast of Australia.”

They have also been at the centre of attempted ratings manipulation through TripAdvisor. In 2014. Meriton was accused of offering reimbursements as well as directly contacting guests to change their ratings on TripAdvisor to a more positive review. In 2018, the Federal Court fined Meriton $3 million “after finding it engaged in misleading or deceptive conduct”.

In 2013, Triguboff purchased a 31,500 sqm site in Mascot for $100 million using his Dark Company Meriton Apartments Pty Ltd.

ATO tax transparency data shows Meriton Properties Pty Limited (parent of Meriton Apartments) declared an income of $10.2 billion between financial years 2013/14 to 2018/19. Over this time, their tax payable was $678.5 million, representing a tax rate of just 10% of taxable income.