Norway delivered its oil & gas riches to its people, Australia delivered the profits into foreign hands, having done the exploration, spending years and billions proving up giant gas fields. As the gas cartel rakes in the profits exporting LNG at the expense of local consumers Clinton Fernandes presents a timely reminder of the enormous public subsidies for large corporations.

In December 1970, Geoscience Australia, then known as the Bureau of Mineral Resources, Geology and Geophysics, began conducting underwater scientific explorations of Australia’s offshore geology.

A specially designed ship circumnavigated Australia, trailing a proton precession magnetometer 200 meters behind it in order to detect iron-rich objects.

The ship carried a marine gravity meter mounted on a gyro-stabilized platform in order to measure variations in the earth’s gravitational field.

These measurements revealed Australia’s underwater structure: the locations of rifts, faults, basins, and other features. The ship also took seismic soundings using a six-channel hydro-streamer cable and a single-channel cable.

It used two depth sounders, one designed for shallow water and the other for deep water, to measure water depths.

This project was the biggest single systematic marine survey ever done anywhere in the world, collecting geo-scientific data covering almost 200,000 square km. The Bureau went from knowing almost nothing about the offshore features to having a good idea of where the underwater plateaus, terraces, trenches, canyons and other features were located, what their dimensions were, where they were steep and where shallow, and how they were all organised together offshore.

Many years of data processing took place after the surveys. The process began when John Gorton was Prime Minister and continued all the way to Bob Hawke’s era.

The Bureau extended its exploration in the 1980s. A purpose-built ship equipped with sophisticated geophysical equipment mapped the resource potential of Australia’s offshore features. Its air compressors, air gun arrays and seismic streamer reels occupied 342 square meters of space over three decks.

Heavy geological equipment was also on board, such as a large coring and dredging winch containing ten kilometres of wire rope with a breaking strain of over 20 tons. This winch was the largest of its kind on an Australian ship and enabled the Bureau to take rock and sediment samples from the deepest part of the seafloor around Australia. The geological equipment and laboratories occupied 170 square meters of space over three decks.

The machinery wasn’t the only aspect of the project. Seismic data collection was a continuous, 24-hour operation from 20 to about 40 days. Three shifts of two technical officers monitored navigational and seismic acquisition. Two shifts of two engineering technical officers maintained compressors and air guns. An electronic specialist maintained the hardware, and two systems geophysicists on 12-hour call ensured data quality control. Five additional scientific crew were involved, as were experts in micropaleontology, geochemistry, heat flow, and side-scan sonar.

Gas deal: “a massive transfer of wealth from gas customers to China and Singapore”

The Commonwealth’s aim was to support the interests of petroleum companies by reducing the element of risk involved in exploration. It wanted the project to collect “the same kind of data that are the principal tool of the petroleum exploration industry — high quality, deep penetration multichannel seismic reflection data.” Would the petroleum companies pay for all this? No, said the Hawke Cabinet in March 1988,

“Product sales are unlikely to return more than 5% of total program costs in the long term.”

The overriding concern was to encourage petroleum companies to invest.

According to the Cabinet Minutes of March 22, 1988, the Treasury Department objected to all this valuable information being given away. It asked why “the Government should be willing to accept higher risks than the industry which primarily stands to benefit from any success.” It pointed out that “market failure in the petroleum exploration industry has not been demonstrated. At the least, increased industry participation in the program is warranted, and this would be best achieved by a much more substantial level of cost recovery.”

Extract from Cabinet Minute No. 10805 of March 22, 1988

The Finance Department also spoke up, saying it was “concerned at the lack of visible evidence of industry participation” in the scientific surveys. In particular, it said, a “level of cost recovery well in excess of the five percent of program costs” was warranted. It was not as though the offshore exploration sector suffered from too much competition. On the contrary, the Finance Department argued, there was a “high level of industry concentration in offshore exploration” and this small sector would derive “significant benefits promised by the [scientific surveys] in reducing exploration risks.”

Extract from Cabinet Minute No. 10805 of March 22, 1988

But Australia’s Department of Foreign Affairs insisted the “national interest” required nothing less. Thus, the Australian public funded the costs and – crucially – the risks of investment in fundamental research and the corporate sector benefited from the energy riches in the continental shelf. In reality, this meant that a tiny minority of people in control of huge concentrations of capital were able to set up the North West Shelf Gas Project off the coast of Western Australia, near the Pilbara town of Karratha.

On September 4, 1984, West Australian premier Brian Burke formally opened the $27 billion Project, which was operated by a then little-known company called Woodside Petroleum. It began exporting liquefied natural gas (LNG) in 1989. The Project has today become one of the largest LNG producers in the world. Woodside has become Australia’s largest natural gas producer, and one of the top 20 stocks in the Australian Stock Exchange (ASX) by market capitalisation.

In return, according to Woodside’s own calculations in February 2017, the government received approximately $26 billion in royalties, excise and taxes from the North West Shelf Project since it began in 1984.

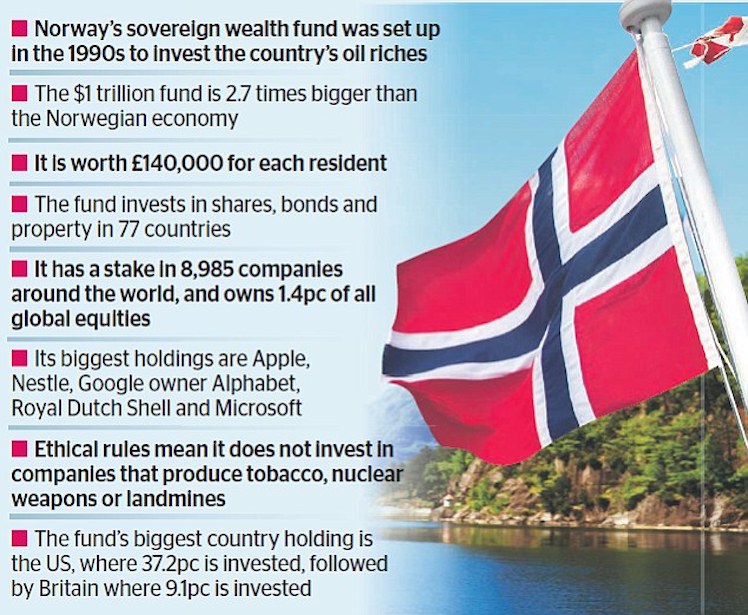

In contrast, Norway made better use of the oil and gas in its continental shelf. The Norwegian government owns two-thirds of the shares in Equinor, formerly known as the Norwegian State Oil Company. Equinor’s workers elect three of the 11 directors.

The Norwegian government created the Government Pension Fund Global in 1990 to invest Norway’s oil revenue. The Ministry of Finance owns the fund on behalf of the Norwegian people, and determines its investment strategy. The Fund had more than 9 billion kroner (almost $1.5 trillion Australian dollars) in 2019. This was a handsome investment for a country with less than six million people.

Norway’s Sovereign Wealth Fund

The Commonwealth should have insisted on equity in the North West Shelf Project at the very beginning, when share prices were affordable. It could have insisted on income-contingent loans in the same way that Australian students are required to pay back their university fees once their incomes exceed some amount. The Commonwealth could have insisted on a golden share of any patents that came out of subsidised research. These alternatives would reward inventors whilst also giving society some additional benefits.

But in Australia, in the absence of a nationally owned energy company, the “national interest” amounts to the socialisation of costs and risks, and the privatisation of profits.

Editor’s Note: As per the MW Top 40 Tax Dodgers and associated commentary, the industry is responsible for Australia’s most aggressive tax avoidance. The hydrocarbons riches, which belong to the people, have not been shared fairly.

Worried about agents of foreign influence? Just look at who owns Australia’s biggest companies

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Clinton Fernandes is Professor of International and Political Studies. He holds dual appointments at the School of Humanities and Social Sciences and the Australian Centre for Cyber Security. His research agenda is linked to the Australian Research Council’s strategic priority area of "Securing Australia’s place in a changing world."