Despite Treasurer Frydenberg’s $1080 tax cut, the retail sector is now in its third year of per capita recession and it’s not just the internet to blame. Alan Austin unpacks the latest retail sales data and how it reflects Australia’s poor economic management.

The collapse last week of chic furniture retailer Zanui has cost many customers a lot of money and considerable anguish. Not to mention staff now jobless. But there is one positive, if we think laterally.

Frydenberg breaks new record! 1st tax cut in history to lead to FALL in consumer activity! Retail sales volumes fell 0.2% in 3 months to September, against rise of 0.1% in June quarter. Ah, sums up Bernard Keane: $1080 tax refund = 1080 notorious poison! https://t.co/vUCs0PXrbG

— ?Sandi Keane (@Jarrapin) November 5, 2019

Hundreds of retailers have closed in Australia over the last few years, so Zanui’s demise is nothing new. But supporters of the Coalition Government, including business councils and the mainstream media, have blamed this on increased online sales.

For example, just in September, ABC News claimed liquidated fashion retailer Forever 21 was one of many companies to “have filed for bankruptcy as more customers shift to online retailers such as Amazon.”

The Financial Review also asserted recently that “a growing list of bricks-and-mortar groups have succumbed to the onslaught of e-commerce companies such as Amazon.”

Now, here’s the thing. Zanui is an online retailer. Or was. It was not a bricks-and-mortar store. So the retail slump has nothing to do with the shift to online sales, but everything to do with the vast wealth currently generated in Australia not being shared equitably. If we understand this, we can begin to see causes and find workable solutions.

Shirking the shopping

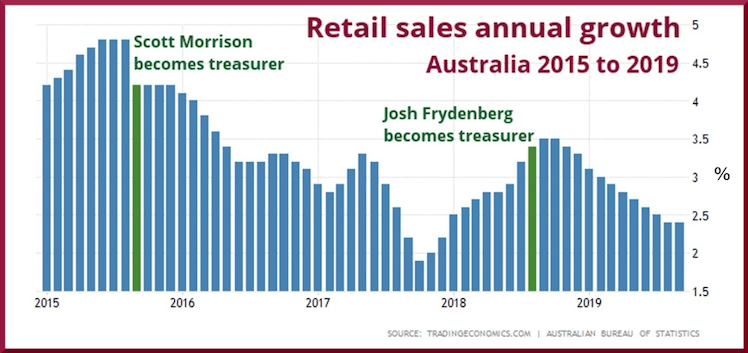

The Australian Bureau of Statistics (ABS) has reported an disturbing decline in retail sales since 2016 when annual growth in the sector fell to an alarming 3.45%. These ABS numbers on retail sales actually include online sales. The economics reporters at the ABC and the Fin Review really should know this.

We now have retail sales figures for the full first quarter of the current financial year. They confirm Australia’s local economy is in a serious long-term decline.

Retail sales for the September quarter came to $82.6 billion, up just 2.48% on the same quarter a year ago. With inflation at 1.7% and population rising 1.6%, that is a decline in real terms relative to population. So the sector is now in its third year of per capita recession.

This follows a rise of just 3.42% in the first quarter a year ago, and a miserable 2.43% for the equivalent quarter two years ago. Three years ago, the rise was just 3.25%. So for four straight years, retail sales growth in the first quarter, July to September, has been below 3.5%. That’s since Scott Morrison became treasurer, and then prime minister.

Privatisation Fetish and QE: will government surrender the economic rescue to the banks?

This is the only time this has happened since records began back in the Fraser years. In fact, only once have there been two consecutive years of retail sales growth below 3.5%. That was during Paul Keating’s “recession we had to have” in 1993, and was followed by lifts of 8.4% in 1994 and 8.0% in 1995.

So it’s fair to say the retail industry is doing it tougher now than at any time since the ABS has been keeping track.

Other retailers to fold in the last year include Karen Millen, Ed Harry, Skins, Napoleon Perdis, Topshop, Shoes of Prey, Stylerunner and Benny Burger. Several chains, including Roger David, Big W and Target are closing stores.

What makes this so bizarre is that all the indicators of wealth and income generation in Australia are at record highs — export values, the trade surplus, the current account surplus, corporate profits, executive salaries and stock exchange indices. Well-managed economies worldwide are enjoying excellent retail results.

The industry feigns bewilderment

Bewailing his industry’s fate this week, executive director of the Australian Retailers Association, Russell Zimmerman, said ABS retail trade figures for September showed the sector “stuck in neutral.”

“These numbers aren’t dreadful; they’re not a success; they’re just flat … it’s disappointing and frustrating,” Zimmerman said.

No, Mr Zimmerman, retail sales are dreadful. They are not flat. They are appallingly bad, given global conditions.

Israel, Poland, Malta, Hungary and Malaysia have annual sales growth better than 5.0%. The Czech Republic, China, Romania and Ukraine are all above 7.0%. Japan, Colombia, Vietnam and Macedonia have growth above 9.0%.

Of the 36 developed countries in the OECD, Australia now ranks 23rd on retail sales growth, down from near the top during the Labor period.

“One would have to express some frustration that after a 3% minimum wage rise, multiple cuts in official interest rates and the $1,080 PAYE tax rebates that a large majority of Australians will have received by now, these measures appear to have made no appreciable impact to date on retail spending,” Zimmerman said.

He added that “there was ample evidence that there was plenty of money around the economy …”

Reserve Bank condemns Coalition mismanagement … not in so many words

Why is this happening?

Zimmerman’s problems include these:

First, a minimum wage rise of 3% is pathetic, given the extraordinary revenues flowing into all developed economies, including Australia, during this current global upturn.

New Zealand has hiked its minimum wage by 7.3% over the last year. Hong Kong, the Czech Republic, Estonia and Belarus have all increased it by more than 8.0%. Bulgaria, Chile, Indonesia and Romania have lifted it more than 9.0%. The rise in Malaysia, South Korea and Ukraine is above 10.0%. Spain is up 22.2% and Lithuania 38.8%.

Second, many taxpayers received much less than the touted $1,080 tax rebate. Australia’s tax regime is now rigged to advantage the rich over the poor and middle.

Third, yes, there is plenty of money flowing in. But most goes to the top end who do not spend in the shopping malls. According to Credit Suisse’s latest global wealth report, the richest ten per cent of the population now hold more wealth than ever before, and the bottom 40% – who spend most of their discretionary incomes in the retail sector – hold less than ever before.

It would seem in the retailers’ interests for their peak body to be a bit more proactive in urging the Government to revert to the policies in place before it took office. Or, better still, lobby for a change of government. Until either of those eventuates, we should expect more retailer bankruptcies. Both shops and online.

—————-

https://www.michaelwest.com.au/hospital-pass-josh-frydenberg-and-the-coalition-as-ahem-superior-economic-managers/

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.