John: Shares are riskier than Australian bank interest, right?

Peter: Correct.

John: It looks to me that the riskier investment gets the government support.

Brenda and John take a moment to ponder what had sparked their curiosity in franking credits in the first place. It was the day the Commonwealth Bank sent them two cheques: one for the 6.2 per cent dividend on their $7000 worth of CBA shares and another for the interest on their 2 per cent $7000 deposit account.

They had slowly pieced the franking credits puzzle together but there were some little issues nagging away at them, not least that they got a payment for investing in shares, which were supposed to be high risk, but no payment for investing in a bank deposit, which was supposed to be low risk.

What was the government up to? They gathered again around the kitchen table to figure it all out.

————————————–

Brenda: When we had our first chat [see Episode 1], we noticed the big difference between the $431 CBA dividend and the $140 CBA interest we received. Both came from $7000 we had in bank shares and the other $7,000 we had in that deposit account.

The dividend came with a 42.8 per cent bonus of $185 from the government which we could use to pay our tax or to pocket, depending on who we were. But the 2 per cent interest came with nothing.

John: I remember your twin sister Susan rang from America and she said that CBA had kept 10 per cent of her interest and sent it to the government. [see Episode 2].

Peter, you said that was because she was now treated as a foreigner and the law meant that CBA had to withhold 10 per cent, so she ended up with $126 out of $140. But we didn’t work out what happened to the rest of us.

Peter: Well the first thing is: let’s look at the clear winners – if you don’t pay any tax at all, then your interest is, obviously, tax free too.

So that’s got Penny Baker and her Self Managed Super Fund sorted. Her SMSF pays no tax on anything it receives and she pays no tax on anything the fund gives her. It’s in tax-free pension phase. And she’s a tax-free franking credit pensioner. Result: she gets 100 per cent of the interest: no tax to pay, cash in hand.

Let’s do some examples. If you’re marginal is less than 30 per cent, you’ll be a winner. And if its greater than 30 per cent you’ll be out of pocket.

Brenda: What about me? I’m on 19 per cent marginal.

Peter: It works like this: after your franking credits were used to pay the tax on your share money, you had $68 left over. So, $27 goes to pay your tax on the interest, leaving you with $41 cash in hand. Well done Mum, all taxes paid by the franking credits and you’re cash in hand. Nice one. [See Episode 2)

John: What about me? I’m on 32.5 per cent marginal.

Peter: Bad luck Dad. All your franking credits were used up paying the tax on your share money. So, you’re taxed on your interest at your marginal rate. Same as Uncle David and Uncle Steve because of their high marginals. You’re out of pocket.

John: Well, Mr G then? He received the interest in his accumulating super fund. It pays tax at 15 per cent flat.

Peter: His fund is looking good: after his fund’s franking credits are used to pay the tax on the dividend, it had $92 left over. So, $21 goes to pay tax on the interest, which leaves $71 cash in the fund. Mr G has done rather nicely too. But no one comes near Penny. She got the whole $140 interest and kept the lot.

John: Can we simplify this. I want to see shares v interest. What does it boil down to?

Peter: OK. Here’s a table that sets it all out.

I’m going to ignore the fact that some people, like you Dad, had to pay the tax on their interest out of their own pocket and some people, like you Mum, could use franking credits to pay it. Either way, it was your tax that was paid, by hook or by crook.

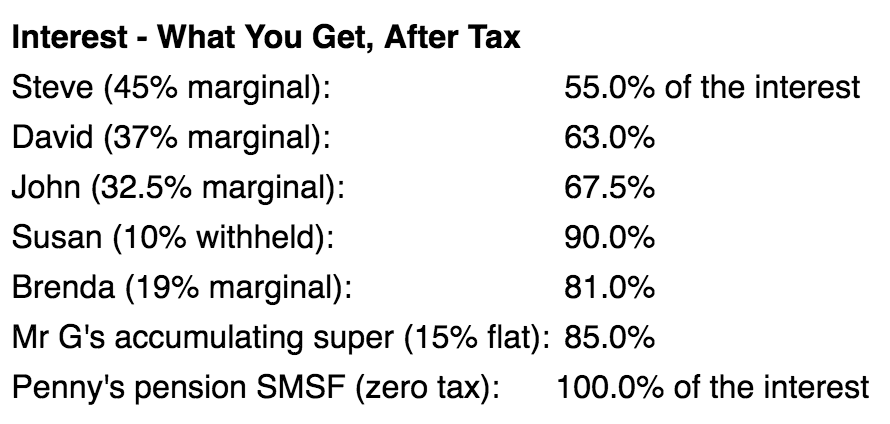

Peter: Looks obvious doesn’t it. Once again, I’ve left out the effect of Medicare and the LITO and LAMITO “offsets” which tweak the numbers a bit. Notice how it ranges between 55 and 100 per cent. That’s how much of the interest each person ends up with, after-tax.

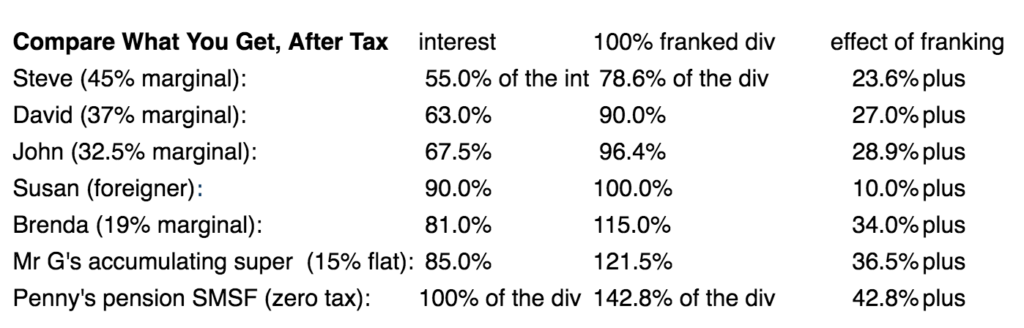

But look what happens when we put it against the 100 per cent fully franked after-Australian-tax dividend. We really get to see what happens when we add in the franking credits.

Notice how it the share money is boosted. It’s now up to a range between 78.6 and 142.8 per cent. That’s how much of share money each person ends up with, after-tax. That boost comes from the government. In column 3 you can see how big the boost is – everyone gets different amounts. But Penny comes out on top, as usual.

John: Shares are riskier than Australian bank interest, right?

Peter: Correct. And don’t forget the government guarantees all bank deposits up to $250,000.

John: It looks to me that the riskier investment gets the government’s franking credit support.

Peter: True. When it comes to deposits, the government only pays out if a bank goes belly up. But with dividends, it comes through twice a year.

Brenda: So … the government is supporting the dividends paid by our blue chip companies.

Peter: It seems so.

John: Surely CBA, BHP, Rio, Westpac don’t need the leg up! Their dividends are way more than good old bank interest! Isn’t BHP the biggest mining company in the world? Aren’t these rather high blue chip dividends enough compensation for the extra risk?

Peter: Not according to the Australian tax system.

Sources: ASX website, APRA website, Australian Taxation Office website, Department of Human Services website, Productivity Commission website, Association of Superannuation Funds of Australia website.

——-

Next Episode: Peter returns to the big questions and digs a little deeper. He tries to work out how much company tax the government keeps. And finds out how a company’s dividend “payout ratio” is one of the many things which affects the outcome.

The Facts of Life: Qantas, the CBA and the Franking Credits Factory

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.