Its critics say the Turnbull government’s National Energy Guarantee (NEG) is as effective a program for reform as a wet lettuce but state governments and the Australian Competition & Consumer Commission are rethinking the way energy assets ought to be valued, and the upshot may be lower energy prices.

For competition tsar Rod Sims, it has been a source of irritation for some time that most of Australia’s gas pipelines are unregulated and they charge users a heavy toll for gas transmission.

The pining from Sims however appears to be bearing fruit, coupled with pressure from businesses pushed to the brink of survival by spiralling gas prices.

A new report by leading infrastructure analyst Rob Koh of Morgan Stanley is predicting a change in the way pipelines are valued may have a dramatic effect on pipeline operators.

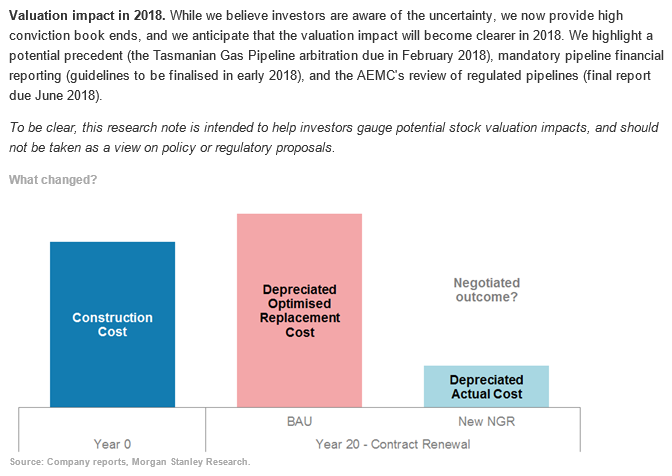

Bear in mind that these changes only effect gas pipelines but the rising price of gas also drives electricity prices higher as, gas is a significant swing factor in electricity generation. Until now, pipelines have been valued – and therefore the financial returns to pipeline operators struck – by way of the fanciful DORC method (Depreciated Optimised Replacement Cost).

This has led to a ludicrous situation where pipelines and other energy assets which are decades old are valued as if they had to be replaced at today’s prices. As an ad absurdum example of how DORC works and the boon it is for rapacious energy companies, if the Sydney Harbour Bridge were to be privatised today, its operators could claim a financial return under DORC based not just on the cost of replacing the Bridge today but of optimising it too.

DORC rort: The art of getting energy infrastructure paid for twice

In August 2017, the Council of Australian Governments (COAG) amended the National Gas Rules (NGR) for unregulated gas pipelines in a way that Morgan Stanley analyst Rob Koh says, “surprised the market, pushing notional asset bases towards zero, despite years of remaining operational life, and a fall-back regulatory regime based on replacement cost”.

The new Recovered Capital Method (RCM) of valuing pipeline assets uses the Depreciated Actual Cost method, a traditional way of valuing these things, rather than DORC which is peculiar to Australia and has been a major culprit in rising electricity and gas prices.

Koh says Depreciated Actual Cost (DAC) valuations may be introduced in 2018 and regulators may also insist on disclosure of pipeline costs, all of which may lead to a reduction in “contract renewal tariffs”.

A measure of how dramatic these changes are lie in Koh’s forecasts. Koh is writing for professional investors on the share market rather than a consumer audience, yet he predicts a potential 28 per cent valuation drop for the sector leader APA Group (“28 per cent DCF downside”).

The market in Australia is dominated by three gas pipeline players of which APA is the leader. APA’s share market returns have been dazzling but this lucrative oligopoly has thrived at the expense of consumers. IEEFA analyst Bruce Robertson has long argued that Australian pipeline operators should be compelled to disclose the financials of their individual pipelines, as they are required to do in the US.

It’s a gas! Australian gas is a bargain … if you’re Japanese

According to Koh, APA generates around 65 per cent of its earnings before interest, tax, depreciation and amortisation (EBITDA) from unregulated pipeline tariffs, “around 27 per cent of which (~$390m out of $1,470m FY17 EBITDA) is up for renewal in the next decade. Furthermore, the Australian Energy Market Commission (AEMC) is reviewing regulated gas pipelines in 2018 against this backdrop (a further ~23% of APA’s EBITDA)”.

Koh reviewed all publicly available information on all of APA’s assets and, for the first time, modelled potential DAC outcomes for APA’s Southwest Queensland Pipeline (SWQP) and Moomba Sydney Pipeline (MSP) to come up with the 28 per cent impact on valuations.

His conviction of the substantial impact of regulatory changes was, he said, “high” and he also said guidelines for mandatory pipeline financial reporting would be finalised early this year.

This is not great news for investors in APA but it is potentially a game-changer for consumers. If successful in bringing the changes, Rod Sims and the ACCC may argue the case for DORC to be dropped as a valuation tool for electricity companies which have long gamed regulators by claiming excessive asset values for their poles and wires and driving excessive financial returns (gold plating).

Clearly the conflict of interest in a system where “the more you spend, the more money you make” has been a major factor in Australia’s energy debacle. Even while demand for energy has flatlined and fallen, prices have continued to rise as the industry is paid according to its inflated forecasts.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.