Incredibly distressing footage of thousands of Australians, across the country, queueing around the block for Centrelink, then a desperate parliament working into the night to shove through its third bail-out package in as many weeks, each one more urgent then the last. As the country runs short of critical medicines and life-saving protective gear, Michael West reports on those profiting from the tragedy.

“It’s like sending a soldier to war without a helmet and enough bullets … I’m desperate to protect my wife and my children”.

Steve called last night. His wife is a doctor in a Victorian hospital where they are running out of surgical masks and protective gear – the white hazmat suits seen mostly on foreign news coverage.

Not only are doctors around Australia dangerously vulnerable to being infected with coronavirus by their patients, their own families are at high risk.

Meanwhile, profiteers are flogging N95 masks on eBay for up to $10 a pop. “We have to buy them on eBay ourselves because the hospital is running out,” said Steve.

Multinational tax dodger eBay pays almost no tax in this country, nor does its associate Gumtree. Gumtree is based in Holland for tax purposes. It is only called Gumtree for marketing purposes.

Yet, if eBay and Gumtree directors and executives are infected with the Coronavirus, they will receive the same treatment as any other patient in Australian hospitals, care from doctors and nurses working around the clock, care financed by ordinary taxpayers.

Overnight, the Therapeutic Goods Association (TGA) issued a release. According to the TGA, over 500 medicines are now in short supply. It is worse than that though says Dr James Freeman: “Despite the fact that no suppliers have stocks of the three medications listed here – mainline antibiotic, 30% of the asthma preventer market, and an Ace Inhibitor – none of these are yet on the critical shortage list despite zero availability,”.

Coronavirus is accelerating. Human life is at risk. But also in the press yesterday were brewing executives and their PR machines whining about their workforces:

“Australia’s biggest beer company, Carlton & United Breweries, and its large rival Lion are both worried that the nation could run out of beer for three months if their breweries are included in a shutdown of industry.”

That was the story in the Fin Review. There was another just like it in The Australian. We might run out of beer.

Like the oil and gas majors, the big brewers are foreign multinationals which siphon a lot of Australia’s wealth offshore. As queues rap around Centrelink offices across the country, it is worth considering that those who, dollar-for-dollar, contribute least to the services of this nation in which they operate often also ask for the most.

Domestic violence programs, for instance, are funded by taxpayers and a lot of domestic violence is fuelled by alcohol. As millions of Australians are forced to stay home and stock up at the bottle-o, domestic abuse will surely escalate as tensions rise.

Yet the nation’s largest brewer, SAB Australia, which owns Carlton & United Breweries (CUB), has raked in at least $8.5 billion from beer drinkers over the past five years and paid zero income tax. Kirin, the Japanese brewing giant which controls another third of the beer market, is little better.

Shut the gate, the horse has bolted

So devastating is this crisis that the Government will see little in tax payments from large corporations this year. Tax losses will erode Australia’s budget for years.

For thoroughbred tax bludgers such as LendLease, EnergyAustralia, News Corp and Origin Energy, the horse has bolted. The tax has gone. It has gone to shareholders, many offshore, many in tax havens. Same deal for their multinational peers such as Exxon, Chevron, Glencore, Shell and Brookfield. The tax has gone and it won’t be coming back.

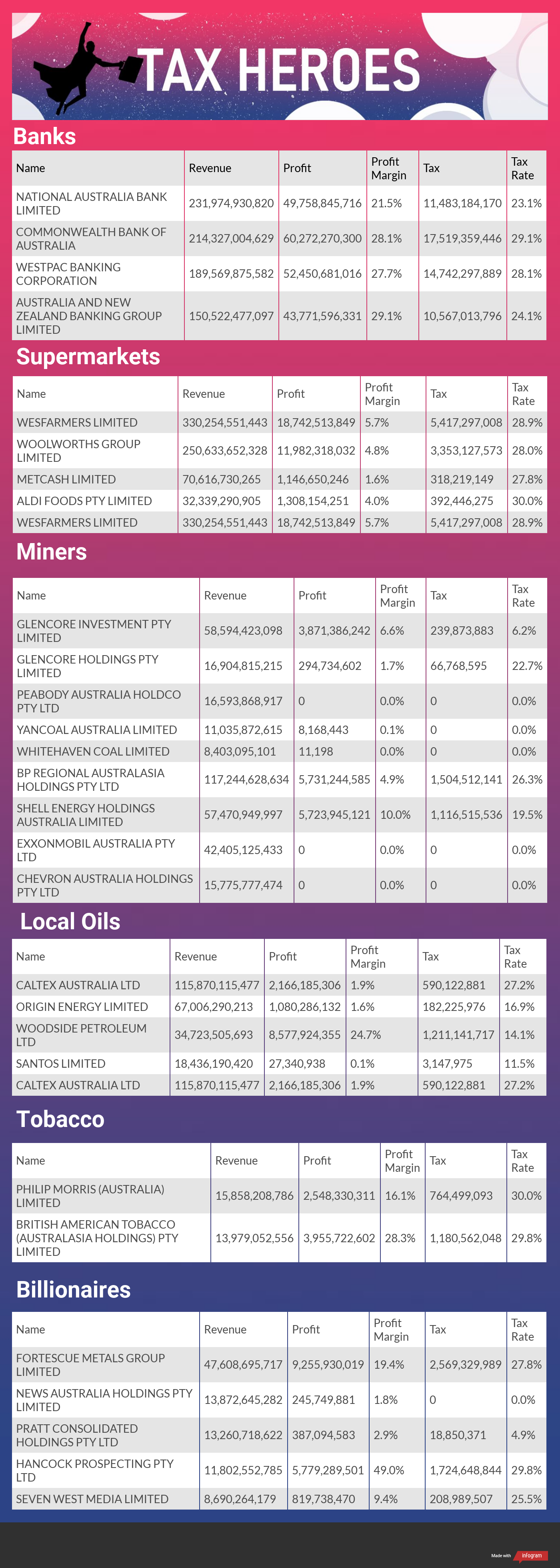

But the magnitude of this crisis does present a rare opportunity, the opportunity for real reform, the opportunity to ensure that all people and all institutions – no matter how crafty their tax advisers – pay their fair share. The table below compares large corporate tax payers, some heroes and some villains in a corporate tax sense. The banks, despite their foibles, pay their fair share, as do the supermarket chains, who are doing such a terrific job at the moment.

Is it reasonable, at such a difficult time, to point the bone at large corporate tax avoiders? We believe it is crucial. Political ideology has failed. The economy is supposed to serve the people, not be an end in itself. Sadly, neo-liberal thinking has it that the people are there to serve the economy. So it is that $50 trillion or so is sitting in tax havens while medical supplies run short.

So it is that the big business lobby, which has suckered politicians for decades, now pleads for the support of government and taxpayers even though they have called for less secure conditions for workers and lower taxes for business and done nothing to stop the exodus of capital to tax havens.

Now is the time for government to rework its contract with the corporate lobby, to get real about tax avoidance, cap the years in which tax losses can be claimed and demand far greater disclosure and accountability. Billionaires and their entities need to disclose financial statements, not hide behind grandfathering laws.

Government needs to cut out the outsourcing of government to Big Four accounting firms and other advisers. The bureaucracy has been gutted. They cut 3,000 jobs from Centrelink last year and the system is now broken.

Despite their history of systemic fraud, the banks are starting to come good in the present crisis, albeit backed by taxpayers via the various government emergency measures. If the business lobby wanted to be useful, rather than trotting out suggestions for politicians, it could look to its own backyard.

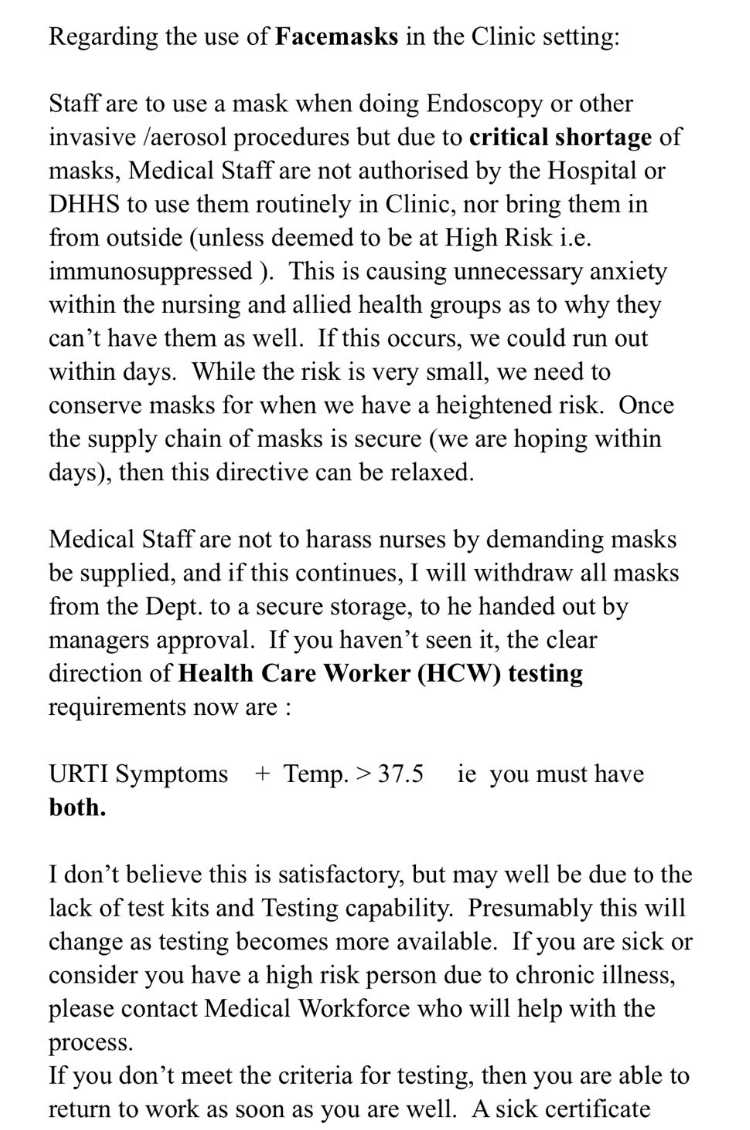

Who is going to talk to eBay about its extortionate behaviour with surgical masks? Will eBay contribute something to earn a social licence to operate in this country? How about Booking.com, Uber, Expedia and AirBNB? Notorious tax avoiders all. While profiteers on eBay make a killing, hospital staff are receiving memos about the critical shortage of disposable masks, like the one below:

Excerpt from a hospital memo warning about the critical shortage of surgical masks.

Who will tap BP on the shoulder for avoiding billions in tax while the oil price has plunged and its service stations are charging $1.88 for litre of petrol? Is anybody watching Big Pharma, which pays little tax but reaps more than $10 billion a year from the Pharmaceutical Benefits Scheme?

————————-

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.