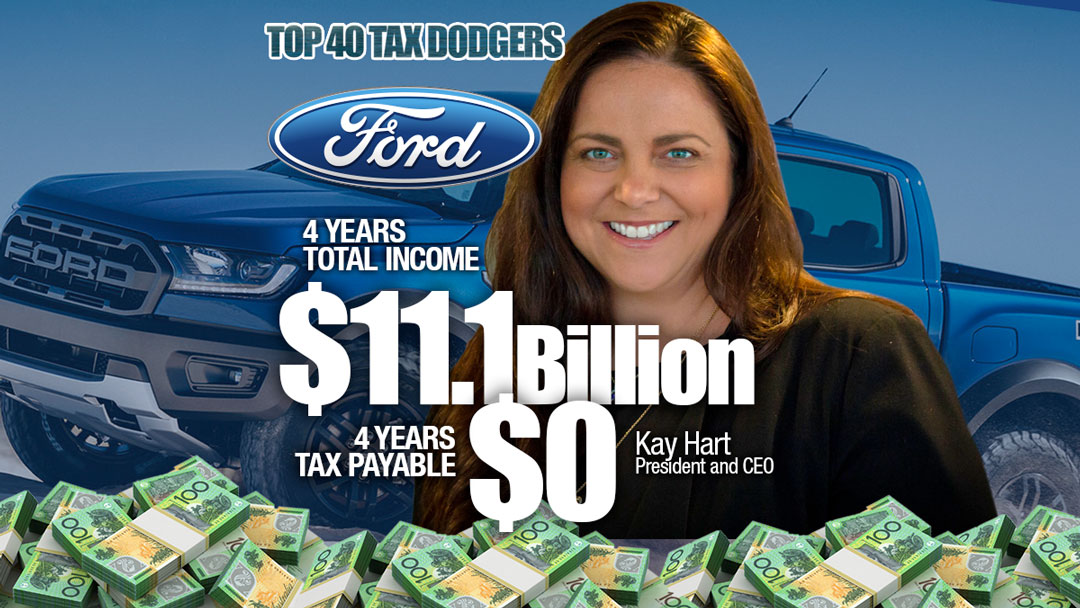

Ford Motor Company of Australia Ltd

Over four years of available transparency data from the Tax Office, Ford has booked over $11 billion in total income yet paid zero tax, despite producing a small taxable profit of $45 million.

When it comes to the worst corporate taxpayers in Australia, the carmakers are right up there with airlines and the oil and gas industry.

Like its rivals General Motors and Toyota, Ford contributes little or nothing to Australia in terms of income tax. Yet the automakers have won billions in government handouts over the years, often made losses and very rarely pay tax.

In the years when they do make a profit, their profits are reduced by transfer pricing and sheltered by large tax losses incurred in the lean years. Though not all of them fail to pay tax. Mercedes Benz is a notable exception.

In defence of Ford, it should be said that this is a high-cost, highly competitive industry and the three automakers on this Top 40 list – Ford, Mitsubishi and Nissan – have collectively recorded total income of almost $30 billion over the four years of available corporate tax transparency data,

Sadly, Ford closed its manufacturing operations in Australia in October 2016 so it has incurred further large losses for redundancies and closure costs since then. The ATO data extends from 2013 to 2016.

Its latest accounts, Ford records a profit of $27 million for the year to December 2017 on revenues of $3.5 billion. Zero tax was paid. Government grants income fell from $41 million in 2016 to $1.6 million in 2017 and the company said it spent $471 million on R&D.

It has also spent $11 million over past two years on redundancies so there are legitimate reasons why Ford is not paying tax.

Due however to Australia having no limit on how long companies can bank tax losses, Ford is unlikely to pay tax for many years to come, even when it does make a profit as it did in 2017. Its accounts show $692 million unused tax losses and another $107 million in tax offsets.

Elsewhere on the Top 40, Nissan at #15 recorded $9.7 billion income over the four years and paid just $476 income tax. Mitsubishi Motors Australia at #23 shows $8.3 billion income and zero tax. General Motors has dropped off the chart this year.

Public support is vital so that we can continue to investigate and publish articles that tell truth to power. Subscribe with a monthly contribution if you can, see below. Join our newsletter, share and like posts, if you can not make a financial contribute.

2019 METHODOLOGY

We are counting down the Top 40 Tax Dodgers. There are now four years of tax transparency data published by the Tax Office and we have used this data to work out which large companies operating in Australia have paid the least tax, or no tax.

Notable new economy players such as Google, eBay, Booking.com, Expedia are not near the top of the ATO list. That’s because they don’t (yet) recognise all income earned here; instead, they book Australian revenue directly to their associates offshore. They will be ranked in due course.

For other large corporations, and in particular, multinationals, the main steps in avoiding tax are made by reducing their taxable as much as they can; usually by sending it offshore in interest on loans, “service” fees or other payments to foreign associates. So, we have set a threshold. We have included only those companies which managed to wipe out 99.5 per cent or more of their taxable income over four years.

Qantas, therefore, is not on this list, although it has enormous income and has paid no income tax in Australia for many years. It misses the cut-off due to it not eliminating more than 99.5 per cent of its total income.

The airline had made large losses which were offset against profits. Many large corporations which have paid zero tax in ATO data, have legitimately made losses and have therefore built up “tax-loss shelter”.

Further explanation of methodology can be found here.

Many others however, such as ExxonMobil and EnergyAustralia, are on the list as they managed to eliminate all or most of their taxable income by “debt-loading” or other means of aggressive tax avoidance.

In this, the second iteration of michaelwest.com.au corporate tax rankings, we have ranked companies purely on the Tax Office data. We will also publish a list of Australia’s better corporate taxpayers, those companies who contribute most to the country in which they operate.

The Tax Office data is not a perfect guide. It does not record refunds, only tax payable and is often at odds with disclosures made for accounting purposes. In some cases, there are multiple entities with the same ultimate offshore parent reporting. One entity may pay zero tax, another may pay at the statutory 30 per cent rate (even if on low taxable income). We endeavour to be fair in our reporting to recognise these issues.

The data also recognises trusts as well as companies. For trusts, it is the members (investors) rather than the trusts who are ordinarily required to pay the tax. In many cases however it is fair to recognise trust structures for what they are, as tax is often the main reason these vehicles have been structured as trusts.

Companies are welcome to debate their rankings or to touch base to clarify or defend their tax practices. We will append or link these submissions.

Hydrox has been taken off the list as it never made a profit.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.