Fletcher Building (Australia) Pty Ltd

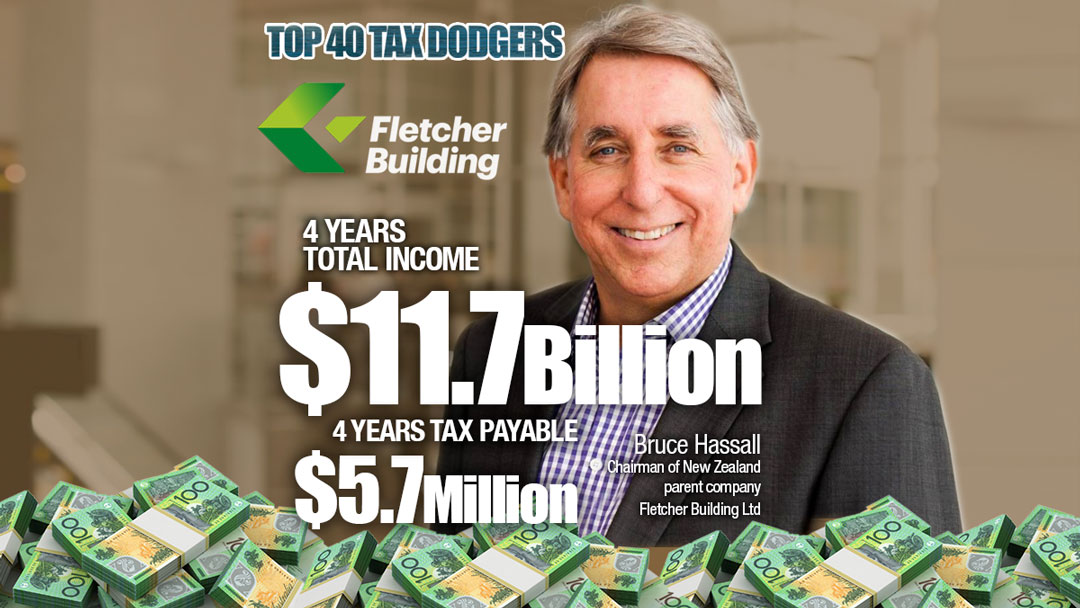

How, during the biggest building boom in history, when you’ve booked $11.5 billion in total income over four years, do you pay a touch under $6 million in tax? New Zealand’s building products juggernaut, Fletcher Building (Australia), managed to do it.

Mind you, Fletcher is the third Kiwi multinational in our Top 40. Along with New Zealand Milk at #26, better known as Fonterra, and Burns Philp & Co at #39, the three trans-Tasman transnationals have recorded $25 billion in total income over four years and paid, well, pocket fluff in income tax.

That’s according to the transparency data from the Tax Office. Corporate income tax is paid on profits of course, not on revenue, and Fletcher Building’s profits have been battered by poor management decisions; so a good deal of its tax avoidance might be deemed “accidental tax dodging”.

In Australia, Fletcher has taken some big hits to the likes of its Tradelink plumbing supplies business and Rocla Pipelines.

Yet Fletcher Building’s Kiwi parent company has been paying tax, as well as dividends. It paid $290 million income tax during the same four years of recorded Tax Office data that its Australian subsidiary – with more than one-third of the cash-flows – paid $5.7 million.

It did 50 times better for its Kiwi revenue authorities than its little Aussie holding company did for the ATO. Lucky executives of both companies get incentive stock in the New Zealand company because it is so much more profitable.

Over the next two years, the Kiwi parent paid $177 million tax but its Aussie subsidiary, according to filings with the corporate regulator, paid just $25 million.

There is a pattern here. It is the pattern of foreign multinationals operating in Australia; they pay little tax while they send off tens of millions of dollars in interest payments to their associated companies overseas.

The foreign company makes the loans, the Australian company pays the interest; in Fletcher’s case, an interest expense of $110 million to its associates over the past two years.

At at June last year, there were $728 million in non-current loans from related parties, according to the latest filings with ASIC, versus just $8.7 million owed to “other”, external lenders.

This is what they call “debt loading”. Yet Fletcher has also generated large tax losses, and those tax losses have shielded the company from paying tax on its profits.

The latest accounts show revenue up from $3.46 billion to $3.64 billion in 2018 for a net profit of $43.7 million. The group paid $16 million in tax, up from $9 million in 2017. Bear in mind these figures are post the ATO data.

Public support is vital so that we can continue to investigate and publish articles that tell truth to power. Subscribe with a monthly contribution if you can, see below. Join our newsletter, share and like posts, if you can not make a financial contribute.

2019 METHODOLOGY

We are counting down the Top 40 Tax Dodgers. There are now four years of tax transparency data published by the Tax Office and we have used this data to work out which large companies operating in Australia have paid the least tax, or no tax.

Notable new economy players such as Google, eBay, Booking.com, Expedia are not near the top of the ATO list. That’s because they don’t (yet) recognise all income earned here; instead, they book Australian revenue directly to their associates offshore. They will be ranked in due course.

For other large corporations, and in particular, multinationals, the main steps in avoiding tax are made by reducing their taxable as much as they can; usually by sending it offshore in interest on loans, “service” fees or other payments to foreign associates. So, we have set a threshold. We have included only those companies which managed to wipe out 99.5 per cent or more of their taxable income over four years.

Qantas, therefore, is not on this list, although it has enormous income and has paid no income tax in Australia for many years. It misses the cut-off due to it not eliminating more than 99.5 per cent of its total income.

The airline had made large losses which were offset against profits. Many large corporations which have paid zero tax in ATO data, have legitimately made losses and have therefore built up “tax-loss shelter”.

Further explanation of methodology can be found here.

Many others however, such as ExxonMobil and EnergyAustralia, are on the list as they managed to eliminate all or most of their taxable income by “debt-loading” or other means of aggressive tax avoidance.

In this, the second iteration of michaelwest.com.au corporate tax rankings, we have ranked companies purely on the Tax Office data. We will also publish a list of Australia’s better corporate taxpayers, those companies who contribute most to the country in which they operate.

The Tax Office data is not a perfect guide. It does not record refunds, only tax payable and is often at odds with disclosures made for accounting purposes. In some cases, there are multiple entities with the same ultimate offshore parent reporting. One entity may pay zero tax, another may pay at the statutory 30 per cent rate (even if on low taxable income). We endeavour to be fair in our reporting to recognise these issues.

The data also recognises trusts as well as companies. For trusts, it is the members (investors) rather than the trusts who are ordinarily required to pay the tax. In many cases however it is fair to recognise trust structures for what they are, as tax is often the main reason these vehicles have been structured as trusts.

Companies are welcome to debate their rankings or to touch base to clarify or defend their tax practices. We will append or link these submissions.

Hydrox has been taken off the list as it never made a profit.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.