Lendlease ‘smoke and mirrors’ corporate shenanigans have come home to roost but there is still at least one big ...

Seven years in the making, Parliament recently passed amendments to the Criminal Code Act that cover foreign ...

In this final instalment of the Housing Hunger Games series, Harry Chemay identifies all policy culprits and all ...

When dealing with the Liquorlands and Dan Murphys of this world, winemakers can be stuck between a rock and a hard ...

The Reserve Bank held rates yesterday, offering some respite for mortgage holders. However, relief is nowhere in ...

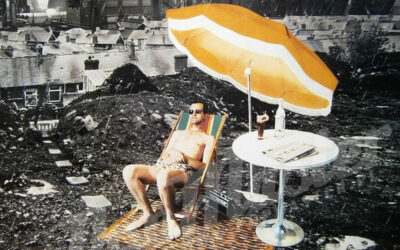

While many feel the pinch of the cost of living crisis, yesterday’s economic growth numbers from the Bureau of ...

Alan Kohler's recent Quarterly Essay is a valiant attempt to put the housing crisis into a historical and ...

“Six armed AFP officers, wearing ballistic vests stormed my apartment ... I was frisked despite still being in ...

A lawyer's first duty is to the Court, the second duty to the client. Shine Justice, or Shine Lawyers as they ...

Why are foreign investors so attracted to Australia? Why is the ASX being hollowed out by takeovers? A UBS ...

Big Australian companies once listed on the ASX are slipping into private hands at an alarming rate. Stephen Mayne ...

Callum Foote has dusted off the accounting standards (AASB) and discovered that Shine Justice and its auditors PwC ...