Media mogul and Bermuda resident Bruce Gordon has ties to the Murdochs, Packers, major Hollywood studios as well as a disgraced former Italian president. He controls six Dark Companies within his regional television empire WIN Corporation which are exempt from lodging financial accounts with ASIC.

| Top 200 Rich List (2020) | No. of Dark Companies: 6 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 111 | WIN Corporation Pty Ltd | Labor Party: $0 |

| Wealth: $892m | WIN Television Network Pty Ltd | Coalition: $4,379 |

| Wealth (2019): $728m | WIN Television NSW Pty Ltd | Independent: $0 |

| YoY wealth change: 22.5% | WIN Television QLD Pty Ltd | Total: $4,379 |

| Crawford Productions Pty Ltd | ||

| Crawford Productions Holdings Pty Ltd |

Growing up in the inner city of Sydney, Gordon spent his days learning magic tricks and juggling fruit at his father’s stall in Pitt St to lure potential customers. Honing his craft, he earned himself a performing gig with Sydney’s Tivoli Circuit in 1952 and later received a managerial position with the exhibition.

Gordon would go on to promote their shows around the country throughout the 1950s. It was during this time when he met Rupert Murdoch who was in the early stages of building his now global media empire out of Adelaide. He also became acquainted with Nine executive Bruce Gyngell; the man hired by Sir Frank Packer to establish Australia’s first commercial television station TCN-9, as well Frank’s sons, Kerry and Clyde.

His exposure in the scene and networking capabilities landed him a sales executive job at prominent Hollywood studio Desilu Productions in 1962. Gordon’s success at the company led to a promotion to president of international TV sales at Paramount in 1974, a role he maintained until his retirement in 1997.

Throughout the 1960s, Gordon had been buying stocks in Australia’s Ten network, building a stake large enough to catch Murdoch’s eye. In 1979, the growing media giant offered Gordon his company Television Wollongong Transmission Ltd in exchange for the Ten shareholdings. Thus was the birth of the WIN Corporation empire which has now expanded into every state of the country.

The Group purchased longstanding Australian media production company Crawford Productions in 1989. They also own a 50% stake in NRL club St George Illawarra Dragons. This means that the rugby league club is primarily controlled by a Dark Company.

During his 35-year tenure on the executive board for Paramount Studios, Gordon became a business associate and close friend to Italy’s longest-serving post-war president Silvio Berlusconi.

With events that transpired surrounding Berlusconi’s family holding company Fininvest, Gordon was subsequently linked to the Italian media and political figure’s arrest in 2013.

The investigation which stretched over many years revealed that Fininvest purchased TV rights from Hollywood studios including Paramount using offshore subsidiaries and sold them to Mediaset, an Italian television business owned by Berlusconi. Mediaset would purchase these rights at an inflated price, allowing the additional funds (approximately $386 million) “to be put into offshore slush funds controlled by Berlusconi and his associates, thus making Fininvest appear less profitable, and slashing its tax burden.”

Gordon was initially a suspect in the case and would provide evidence which saw the former Italian president receive a 4-year jail sentence. Although the judge determined the Australian businessman was not involved in any criminal activity, he noted that Gordon “along with other Paramount executives – was a key part of the curious mechanism whereby certain Paramount rights were sold to … Berlusconi’s Mediaset for inflated amounts”. The case received scant media attention in Australia despite the involvement of one of the country’s most prominent media figures.

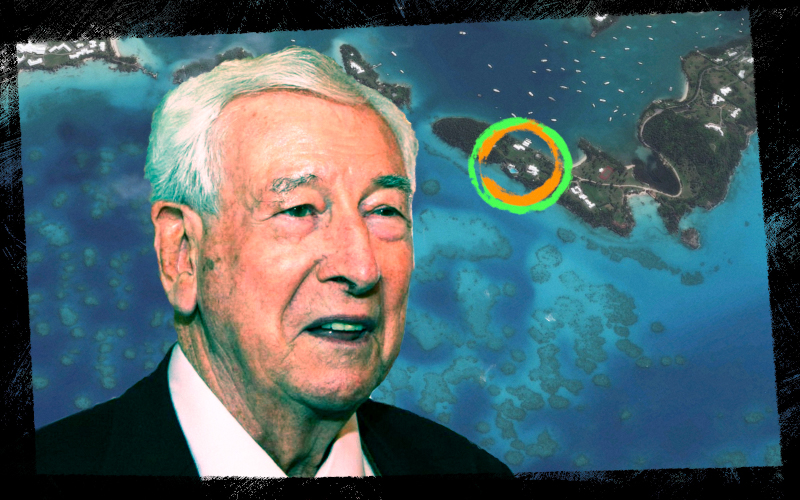

Gordon has been a permanent resident within the tax haven of Bermuda (his estate pictured above) since 1985 where he enjoys certain personal tax arrangements. These arrangements require Gordon to spend more than 183 days offshore within a calendar year. During the pandemic last year, Gordon exceeded his stay in Australia, yet the ATO awarded the multi-millionaire an exemption from incurring an additional tax bill.

Through his private investment vehicle Birketu Pty Ltd, Gordon is the third-largest shareholder in media conglomerate Nine Entertainment with a commanding stake of 14.94%. He was previously a substantial shareholder in the troublesome Ten Network. Alongside Lachlan Murdoch in 2017, Gordon attempted unsuccessfully to make a joint bid for Ten, losing out to US media giant CBS.

He also holds a large stake in another regional media network, Prime, which he utilised in 2019 to block a merger between Prime and Seven.

Yet, Gordon was a big proponent of the $4 billion merger between Nine and Fairfax media in 2018. The merger was a result of changes to media ownership laws passed by the Senate in 2017. The bill abolished the existing rule “preventing one company from owning print, radio and television assets in one market, and TV broadcasters from reaching more than 75% of the population”.

ATO tax transparency data for financial years 2013/14 to 2018/19 (barring 2016/17) shows Win Corporation Pty Ltd (a Dark Company) declared an income of $1.3 billion. Over the five years, their tax payable was $35.2 million, representing 26.9% of their taxable income. However, taxable income for the period was $130.6 million, just 9.6% of their total revenue. In 2018/19, taxable income and tax payable were $0.